What we know

- Hydrogen technologies are here - mature, safe and ready to be deployed at scale.

- The potential is huge – by 2050, hydrogen could meet 18% of the world’s final energy demands, provide 30 million jobs around the world, prevent 6 Gt of CO2 emissions, and create a $2.5 trillion market for hydrogen and fuel cell equipment.

- Successful demonstration projects, large pilots and captive fleets have introduced them to the market around the world and established policy and financing requirements.

- Yet, lack of information, misconceptions and fragmentation have been hampering hydrogen’s global progress.

Hydrogen – scaling up

THROUGH STRONG PARTNERSHIPS

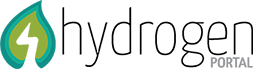

MULTI-STAKEHOLDER GROUPS play a fundamental role in bringing public and private players to the same table, creating strong partnerships to unlock potential and drive mass deployment.

WHAT CAN WE DO ABOUT IT?

NOW is the time for global stakeholders to come together and create an environment that will scale up hydrogen solutions by:

- Speaking one voice to inform stakeholders and educate consumers

- Creating platforms for public-private collaboration

- Sharing know how and resources

- Fostering standardization

- Highlighting market activation and real business cases and how to make them happen

The industry has developed an ambition yet realistic roadmap to show how to get to scale.

Read it here (link) share it with your network and joint the hydrogen revolution. Source Hydrogen Council

Global hot spots and corridors

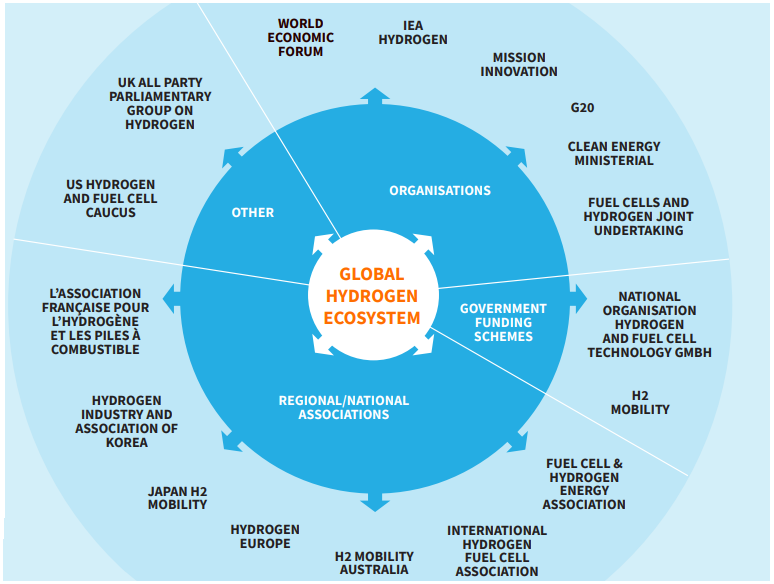

Based on the availability of natural resources and established industry segments, the following observations can be made:

A range of countries from the southern hemisphere are envisioning, or have already positioned, themselves as hydrogen (and its derivatives) exporters, across South America, North Africa, the Middle East and Australia to utilize strong positions for low-cost hydrogen production, either as blue (from a coal/natural gas source) or green (from solar, hydro and wind).

Countries that aim to be technology exporters (for example Japan, Korea, France, and the USA) are in many cases not well positioned to be net exporters.

Only China and Australia are, at this point, expected to become self-sustaining in hydrogen at sufficient scale to meet their ambitious decarbonization objectives.

A detailed description of a region’s import/export relations is outside the scope of this article, but for now we conclude that main corridors are developing across ALL continents, and this tells us that carbon-neutral hydrogen will be a globally traded commodity.

Commitment to formalized hydrogen infrastructure investments are seen across several regions, while development of trading relationships is most mature in Asia Pacific, where Australia is very progressive in plans to become a “future hydrogen export powerhouse”. This is substantiated by formalized MOUs between Australia and Japan/South Korea, respectively.

How national positions and aspirations, turn into national objectives and hydrogen strategies will be the topic of the next article in this series releasing in the coming weeks (Viewpoint 3), where both blue and green hydrogen is of relevance. Here, we will bring in learnings from the world’s first end-to-end hydrogen supply chain project.

The distribution step of the hydrogen value chain

The hydrogen trajectory – to bring down the levelized cost of hydrogen (LCOH), the capital and operational expenditure of energy projects are the predominant factors.

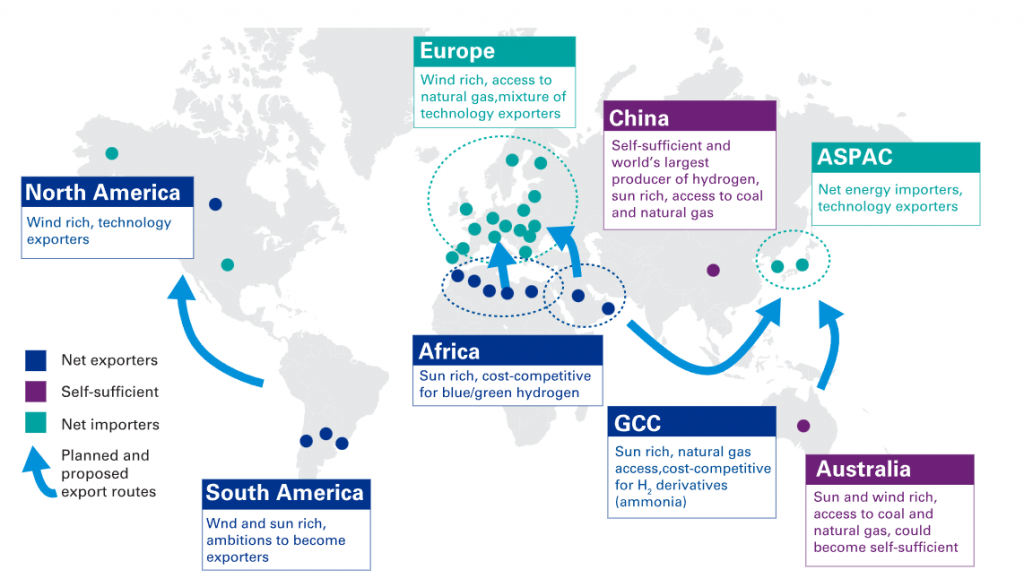

Yet, what is evident from the corridor map above (and while applying an end-to-end perspective on the value chain) is that to connect demand with supply across regions and continents will necessitate trucks, trains and ship carriers, capable of transporting hydrogen safely and cost-effectively over large distances. In other words, low-cost transportation of hydrogen is an important factor for the successful establishment of the hydrogen value chain.

While gaseous hydrogen will be utilized in end applications at pressure levels suitable for the specific function, the transport itself however, needs to apply the most profitable form of logistic, which entails compressing or liquifying the hydrogen gas to optimize the volumetric energy density. For this, modes of transporting hydrogen across larger distances include pipeline, compressed gas cylinders transported by tube trailers or cryogenic tanks via trains or ships with stepwise increase in capacity and reach.

Technical concepts and standards already exist for compressed hydrogen gas cylinders, which can be distributed by tube trailers with up to 26 m3 per tank, according to Hydrogen Europe. This number is higher for liquid H2 due to the higher density (and can be multiple numbers for each lorry), yet transporting the massive demand that global trade routes will face requires hydrogen tankers with capacities equivalent to the likes of oil and LNG carriers.

A first contribution on this journey came in 2019, where a first-ever liquid hydrogen carrier was launched by Kawasaki Heavy Industries, holding a capacity of 1,250 m3 – this may seem insignificant compared to typical LNG carrier sizes (easily exceeding this by a factor 100), nonetheless it marks yet another milestone in the advancement of an upcoming hydrogen economy.

BASIC CONSIDERATION

The time is right to tap into hydrogen’s potential to play a key role in a clean, secure and affordable energy future.

At the request of the government of Japan under its G20 presidency, the International Energy Agency (IEA) has produced this landmark report to analyse the current state of play for hydrogen and to offer guidance on its future development. The report finds that clean hydrogen is currently enjoying unprecedented political and business momentum, with the number of policies and projects around the world expanding rapidly. It concludes that now is the time to scale up technologies and bring down costs to allow hydrogen to become widely used. The pragmatic and actionable recommendations to governments and industry that are provided will make it possible to take full advantage of this increasing momentum.

Hydrogen can help tackle various critical energy challenges.

It offers ways to decarbonise a range of sectors – including long-haul transport, chemicals, and iron and steel – where it is proving difficult to meaningfully reduce emissions. It can also help improve air quality and strengthen energy security. Despite very ambitious international climate goals, global energy-related CO2 emissions reached an all time high in 2018. Outdoor air pollution also remains a pressing problem, with around 3 million people dying prematurely each year.

Hydrogen is versatile.

Technologies already available today enable hydrogen to produce, store, move and use energy in different ways. A wide variety of fuels are able to produce hydrogen, including renewables, nuclear, natural gas, coal and oil. It can be transported as a gas by pipelines or in liquid form by ships, much like liquefied natural gas (LNG). It can be transformed into electricity and methane to power homes and feed industry, and into fuels for cars, trucks, ships and planes.

Hydrogen can enable renewables to provide an even greater contribution.

It has the potential to help with variable output from renewables, like solar photovoltaics (PV) and wind, whose availability is not always well matched with demand. Hydrogen is one of the leading options for storing energy from renewables and looks promising to be a lowest-cost option for storing electricity over days, weeks or even months. Hydrogen and hydrogen based fuels can transport energy from renewables over long distances – from regions with abundant solar and wind resources, such as Australia or Latin America, to energy-hungry cities thousands of kilometres away.

There have been false starts for hydrogen in the past; this time could be different.

The recent successes of solar PV, wind, batteries and electric vehicles have shown that policy and technology innovation have the power to build global clean energy industries. With a global energy sector in flux, the versatility of hydrogen is attracting stronger interest from a diverse group of governments and companies. Support is coming from governments that both import and export energy as well as renewable electricity suppliers, industrial gas producers, electricity and gas utilities, automakers, oil and gas companies, major engineering firms, and cities. Investments in hydrogen can help foster new technological and industrial development in economies around the world, creating skilled jobs.

Hydrogen can be used much more widely.

Today, hydrogen is used mostly in oil refining and for the production of fertilisers. For it to make a significant contribution to clean energy transitions, it also needs to be adopted in sectors where it is almost completely absent at the moment, such as transport, buildings and power generation.

Hydrogen Challenges

Clean, widespread use of hydrogen in global energy transitions faces several challenges:

- Producing hydrogen from low-carbon energy is costly at the moment.

IEA analysis finds that the cost of producing hydrogen from renewable electricity could fall 30% by 2030 as a result of declining costs of renewables and the scaling up of hydrogen production. Fuel cells, refuelling equipment and electrolysers (which produce hydrogen from electricity and water) can all benefit from mass manufacturing.

- The development of hydrogen infrastructure is slow and holding back widespread adoption.

Hydrogen prices for consumers are highly dependent on how many refuelling stations there are, how often they are used and how much hydrogen is delivered per day. Tackling this is likely to require planning and coordination that brings together national and local governments, industry and investors.

- Hydrogen is almost entirely supplied from natural gas and coal today.

Hydrogen is already with us at industrial scale all around the world, but its production is responsible for annual CO2 emissions equivalent to those of Indonesia and the United Kingdom combined. Harnessing this existing scale on the way to a clean energy future requires both the capture of CO2 from hydrogen production from fossil fuels and greater supplies of hydrogen from clean electricity.

- Regulations limit the development of a clean hydrogen industry.

Government and industry must work together to ensure existing regulations are not an unnecessary barrier to investment. Trade will benefit from common international standards for the safety of transporting and storing large volumes of hydrogen and for tracing the environmental impacts of different hydrogen supplies.

Near Term Opportunities

Hydrogen is already widely used in some industries, but it has not yet realised its potential to support clean energy transitions. Ambitious, targeted and near-term action is needed to further overcome barriers and reduce costs.

The IEA has identified four near-term opportunities to boost hydrogen on the path towards its clean, widespread use.

Focusing on these real-world springboards could help hydrogen achieve the necessary scale to bring down costs and reduce risks for governments and the private sector. While each opportunity has a distinct purpose, all four also mutually reinforce one another.

- Make industrial ports the nerve centres for scaling up the use of clean hydrogen.

Today, much of the refining and chemicals production that uses hydrogen based on fossil fuels is already concentrated in coastal industrial zones around the world, such as the North Sea in Europe, the Gulf Coast in North America and southeastern China.

Encouraging these plants to shift to cleaner hydrogen production would drive down overall costs. These large sources of hydrogen supply can also fuel ships and trucks serving the ports and power other nearby industrial facilities like steel plants.

- Build on existing infrastructure, such as millions of kilometres of natural gas pipelines.

Introducing clean hydrogen to replace just 5% of the volume of countries’ natural gas supplies would significantly boost demand for hydrogen and drive down costs.

- Expand hydrogen in transport through fleets, freight and corridors.

Powering highmileage cars, trucks and buses to carry passengers and goods along popular routes can make fuel-cell vehicles more competitive.

- Launch the hydrogen trade’s first international shipping routes.

Lessons from the successful growth of the global LNG market can be leveraged. International hydrogen trade needs to start soon if it is to make an impact on the global energy system.

International co-operation is vital to accelerate the growth of versatile, clean hydrogen around the world.

If governments work to scale up hydrogen in a co-ordinated way, it can help to spur investments in factories and infrastructure that will bring down costs and enable the sharing of knowledge and best practices. Trade in hydrogen will benefit from common international standards. As the global energy organisation that covers all fuels and all technologies, the IEA will continue to provide rigorous analysis and policy advice to support international co-operation and to conduct effective tracking of progress in the years ahead.

Key Recommendations to scale up hydrogen

- Establish a role for hydrogen in long-term energy strategies. National, regional and city governments can guide future expectations. Companies should also have clear long-term goals. Key sectors include refining, chemicals, iron and steel, freight and long-distance transport, buildings, and power generation and storage.

- Stimulate commercial demand for clean hydrogen. Clean hydrogen technologies are available but costs remain challenging. Policies that create sustainable markets for clean hydrogen, especially to reduce emissions from fossil fuel-based hydrogen, are needed to underpin investments by suppliers, distributors and users. By scaling up supply chains, these investments can drive cost reductions, whether from low-carbon electricity or fossil fuels with carbon capture, utilisation and storage.

- Address investment risks of first-movers. New applications for hydrogen, as well as clean hydrogen supply and infrastructure projects, stand at the riskiest point of the deployment curve. Targeted and time-limited loans, guarantees and other tools can help the private sector to invest, learn and share risks and rewards.

- Support R&D to bring down costs. Alongside cost reductions from economies of scale, R&D is crucial to lower costs and improve performance, including for fuel cells, hydrogen-based fuels and electrolysers (the technology that produces hydrogen from water). Government actions, including use of public funds, are critical in setting the research agenda, taking risks and attracting private capital for innovation.

- Eliminate unnecessary regulatory barriers and harmonise standards. Project developers face hurdles where regulations and permit requirements are unclear, unfit for new purposes, or inconsistent across sectors and countries. Sharing knowledge and harmonising standards is key, including for equipment, safety and certifying emissions from different sources. Hydrogen’s complex supply chains mean governments, companies, communities and civil society need to consult regularly.

- Engage internationally and track progress. Enhanced international co-operation is needed across the board but especially on standards, sharing of good practices and cross-border infrastructure. Hydrogen production and use need to be monitored and reported on a regular basis to keep track of progress towards long-term goals.

- Focus on four key opportunities to further increase momentum over the next decade. By building on current policies, infrastructure and skills, these mutually supportive opportunities can help to scale up infrastructure development, enhance investor confidence and lower costs:

- Make the most of existing industrial ports to turn them into hubs for lower-cost, lower-carbon hydrogen.

- Use existing gas infrastructure to spur new clean hydrogen supplies.

- Support transport fleets, freight and corridors to make fuel-cell vehicles more competitive.

- Establish the first shipping routes to kick-start the international hydrogen trade.