Foreword

The number of countries that have pledged to reach net zero emission by mid-century or soon after continue to grow, but so do global greenhouse gas emissions. This gap between rhetoric and actions needs to close if we are to have fighting chance of reaching net zero by 2050 and limiting the rise in global temperature to 1.5 °C. Net zero pledges to date cover around 70% of global GDP and CO2 emissions. However, fewer than a quarter of announced net zero pledges are fixed in domestic legislation and few are yet underpinned by specific measures or policies to deliver them in full and on time.

The Stated Policies Scenario (STEPS) takes account only of specific policies that are in place or have been announced by governments. Annual energy‐related and industrial process CO2 emissions rise from 34 Gt in 2020 to 36 Gt in 2030 and remain around this level until 2050. If emissions continue on this trajectory, with similar changes in non‐energy‐related GHG emissions, this would lead to a temperature rise of around 2.7 °C by 2100 (with a 50% probability). Renewables provide almost 55% of global electricity generation in 2050 (up from 29% in 2020), but clean energy transitions lag in other sectors. Global coal use falls by 15% between 2020 and 2050; oil use in 2050 is 15% higher than in 2020; and natural gas use is almost 50% higher.

The announced Pledges Case (APC) assumes that all announced national net zero pledges are achieved in full and on time, whether or not they are currently underpinned by specific policies. Global energy‐related and industrial process CO2emissions fall to 30 Gt in 2030 and 22 Gt in 2050. Extending this trajectory, with similar action on non‐energy‐related GHG emissions, would lead to a temperature rise in 2100 of around 2.1 °C (with a 50% probability). Global electricity generation nearly doubles to exceed 50 000 TWh in 2050. The share of renewables in electricity generation rises to nearly 70% in 2050. Oil demand does not return to its 2019 peak and falls about 10% from 2020 to 80 mb/d in 2050. Coal use drops by 50% to 2 600 Mtce in 2050, while natural gas use expands by 10% to 4 350 bcm in 2025 and remains about that level to 2050.

Efficiency, electrification and the replacement of coal by low‐emissions sources in electricity generation play a central role in achieving net zero goals in the APC, especially over the period to 2030. The relative contributions of nuclear, hydrogen, bioenergy and CCUS vary across countries, depending on their circumstances.

The divergence in trends between the APC and the STEPS shows the difference that current net zero pledges could make, while underlining at the same time the need for concrete policies and short‐term plans that are consistent with long‐term net zero pledges. However, the APC also starkly highlights that existing net zero pledges, even if delivered in full, fall well short of what is necessary to reach global net‐zero emissions by 2050.

Nationally determined contributions

Under the Paris Agreement, Parties 1 are required to submit Nationally Determined Contributions (NDCs) to the UNFCCC and to implement policies with the aim of achieving their stated objectives. The process is dynamic; it requires Parties to update their NDCs every five years in a progressive manner to reflect the highest possible ambition. The first round of NDCs, submitted by 191 countries, covers more than 90% of global energy‐related and industrial process CO2 emissions.

The first NDCs included some targets that were unconditional and others that were conditional on international support for finance, technology and other means of implementation.

As of 23 April 2021, 80 countries have submitted new or updated NDCs to the UNFCCC, covering just over 40% of global CO2 emissions.

Many of the updated NDCs include more stringent targets than in the initial round of NDCs, or targets for a larger number of sectors or for a broader coverage of GHGs. In addition, 27 countries and the European Union have communicated long‐term low GHG emissions development strategies to the UNFCCC, as requested by the Paris Agreement. Some of these strategies incorporate a net zero pledge.

Global Pathway to net zero Co2 Emission in 2050

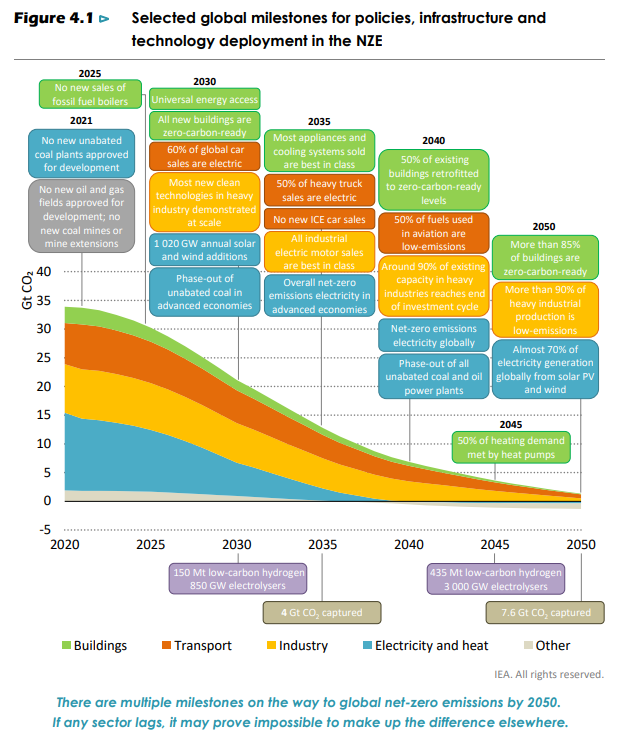

The Net‐Zero Emissions by 2050 Scenario (NZE) shows what is needed for the global energy sector to achieve net‐zero CO2 emissions by 2050. Alongside corresponding reductions in GHG emissions from outside the energy sector, this is consistent with limiting the global temperature rise to 1.5 °C without a temperature overshoot (with a 50% probability). Achieving this would require all governments to increase ambitions from current Nationally Determined Contributions and net zero pledges.

In the NZE, global energy‐related and industrial process CO2 emissions fall by nearly 40% between 2020 and 2030 and to net zero in 2050. Universal access to sustainable energy is achieved by 2030. There is a 75% reduction in methane emissions from fossil fuel use by 2030. These changes take place while the global economy more than doubles through to 2050 and the global population increases by 2 billion.

Total energy supply falls by 7% between 2020 and 2030 in the NZE and remains at around this level to 2050. Solar PV and wind become the leading sources of electricity globally before 2030 and together they provide nearly 70% of global generation in 2050. The traditional use of bioenergy is phased out by 2030.

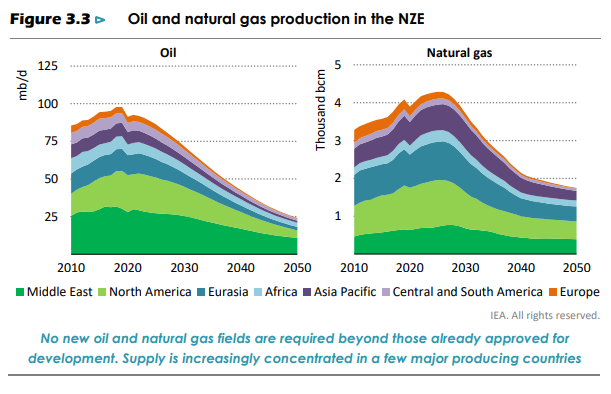

Coal demand declines by 90% to less than 600 Mtce in 2050, oil declines by 75% to 24 mb/d, and natural gas declines by 55% to 1 750 bcm. The fossil fuels that remain in 2050 are used in the production of non‐energy goods where the carbon is embodied in the product (like plastics), in plants with carbon capture, utilisation and storage (CCUS), and in sectors where low‐emissions technology options are scarce.

Energy efficiency, wind and solar provide around half of emissions savings to 2030 in the NZE. They continue to deliver emissions reductions beyond 2030, but the period to 2050 sees increasing electrification, hydrogen use and CCUS deployment, for which not all technologies are available on the market today, and these provide more than half of emissions savings between 2030 and 2050. In 2050, there is 1.9 Gt of CO2removal in the NZE and 520 million tonnes of low‐carbon hydrogen demand.

Behavioural changes by citizens and businesses avoid 1.7 Gt CO2 emissions in 2030, curb energy demand growth, and facilitate clean energy transitions.

Annual energy sector investment, which averaged USD 2.3 trillion globally in recent years, jumps to USD 5 trillion by 2030 in the NZE. As a share of global GDP, average annual energy investment to 2050 in the NZE is around 1% higher than in recent years.

The NZE taps into all opportunities to decarbonise the energy sector, across all fuels and all technologies. But the path to 2050 has many uncertainties. If behavioural changes were to be more limited than envisaged in the NZE, or sustainable bioenergy less available, then the energy transition would be more expensive. A failure to develop CCUS for fossil fuels could delay or prevent the development of CCUS for process emissions from cement production and carbon removal technologies, making it much harder to achieve net‐zero emissions by 2050.

Key pillars of decarbonisation

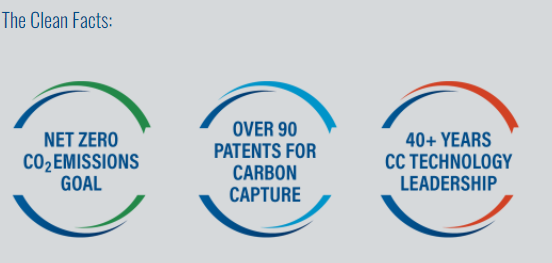

Achieving the rapid reduction in CO2 emissions over the next 30 years in the NZE requires a broad range of policy approaches and technologies. The key pillars of decarbonisation of the global energy system are energy efficiency, behavioural changes, electrification, renewables, hydrogen and hydrogen‐based fuels, bioenergy and CCUS.

Behavioural change

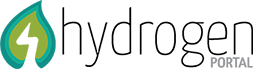

There are three main types of behavioural change included in the NZE.

• Reducing excessive or wasteful energy use

• Transport mode switching.

o This includes a shift to cycling, walking, ridesharing or taking buses for trips in cities that would otherwise be made by car, as well as replacing regional air travel by high‐speed rail in regions where this is feasible.

• Materials efficiency gains.

Electrification

The direct use of low‐emissions electricity in place of fossil fuels is one of the most important drivers of emissions reductions in the NZE, accounting for around 20% of the total reduction achieved by 2050. Global electricity demand more than doubles between 2020 and 2050, with the largest absolute rise in electricity use in end‐use sectors taking place in industry, which registers an increase of more than 11 000 TWh between 2020 and 2050. Much of this is due to the increasing use of electricity for low‐ and medium‐temperature heat and in secondary scrap‐based steel production

Renewables

At a global level, renewable energy technologies are the key to reducing emissions from electricity supply.

Hydropower has been a leading low‐emission source for many decades, but it is mainly the expansion of wind and solar that triples renewables generation by 2030 and increases it more than eightfold by 2050 in the NZE. The share of renewables in total electricity generation globally increases from 29% in 2020 to over 60% in 2030 and to nearly 90% in 2050. To achieve this, annual capacity additions of wind and solar between 2020 and 2050 are five‐times higher than the average over the last three years.

Dispatchable renewables are critical to maintain electricity security, together with other low‐carbon generation, energy storage and robust electricity networks. In the NZE, the main dispatchable renewables globally in 2050 are hydropower (12% of generation), bioenergy (5%), concentrating solar power (2%) and geothermal (1%).

Bioenergy

Global primary demand for bioenergy was almost 65 EJ in 2020, of which about 90% was solid biomass. Some 40% of the solid biomass was used in traditional cooking methods which is unsustainable, inefficient and polluting, and was linked to 2.5 million premature deaths in 2020. The use of solid biomass in this manner falls to zero by 2030 in the NZE, to achieve the UN Sustainable Development Goal 7. Increases in all forms of modern bioenergy more than offset this, with production rising from less than 40 EJ in 2020 to around 100 EJ in 2050. All bioenergy in 2050 comes from sustainable sources and the figures in the NZE for total bioenergy use are well below estimates of global sustainable bioenergy potential, thus avoiding the risk of negative impacts on biodiversity, fresh water systems, and food prices and availability.

Carbon capture, utilisation and storage

CCUS can facilitate the transition to net‐zero CO2 emissions by: tackling emissions from existing assets; providing a way to address emissions from some of the most challenging sectors; providing a cost‐effective pathway to scale up low‐carbon hydrogen production rapidly; and allowing for CO2 removal from the atmosphere through BECCS and DACCS.

Capturing the science behind carbon capture

Key behavioural changes in the NZE

Technology innovation in the NZE

Sectoral pathways to net-zero emissions by 2050

Fossil fuel use falls drastically in the Net‐Zero Emissions Scenario (NZE) by 2050, and no new oil and natural gas fields are required beyond those that have already been approved for development. No new coal mines or mine extensions are required. Low‐emissions fuels – biogases, hydrogen and hydrogen‐based fuels – see rapid growth.

They account for almost 20% of global final energy in 2050, compared with 1% in 2020. More than 500 Mt of low‐carbon hydrogen is produced in 2050, of which about 60% is produced using electrolysis that accounts for 20% of global electricity generation in 2050. Liquid biofuels provide 45% of global aviation fuel in 2050.

Electricity demand grows rapidly in the NZE, rising 40% from today to 2030 and more than two‐and‐a‐half‐times to 2050, while emissions from generation fall to net‐zero in aggregate in advanced economies by 2035 and globally by 2040. Renewables drive the transformation, up from 29% of generation in 2020 to 60% in 2030 and nearly 90% in 2050. From 2030 to 2050, 600 GW of solar PV and 340 GW of wind are added each year. The least‐efficient coal plants are phased out by 2030 and all unabated coal by 2040. Investment in electricity grids triples to 2030 and remains elevated to 2050.

In industry, emissions drop by 20% to 2030 and 90% to 2050. Around 60% of heavy industry emissions reductions in 2050 in the NZE come from technologies that are not ready for market today: many of these use hydrogen or CCUS. From 2030, all new industry capacity additions are near‐zero emissions. Each month from 2030, the world equips 10 new and existing heavy industry plants with CCUS, adds 3 new hydrogen‐based industrial plants and adds 2 GW of electrolyser capacity at industrial sites.

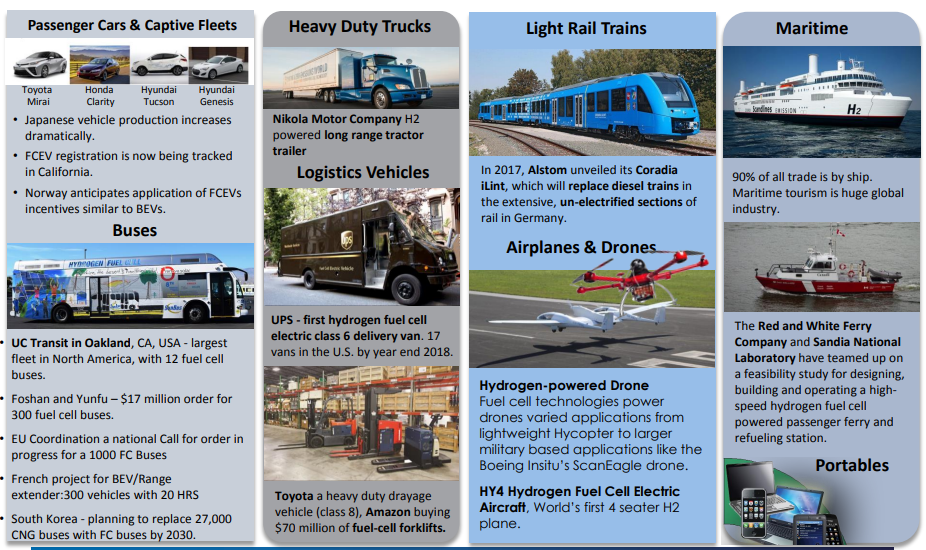

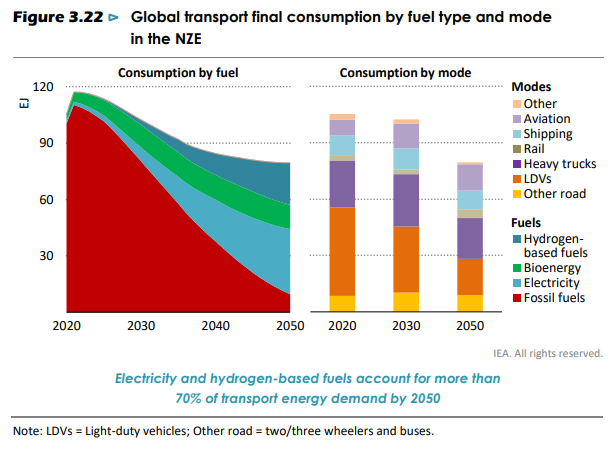

In transport, emissions drop by 20% to 2030 and 90% to 2050. The initial focus is on increasing the operational and technical efficiency of transport systems, modal shifts, and the electrification of road transport. By 2030, electric cars account for over 60% of car sales (4.6% in 2020) and fuel cell or electric vehicles are 30% of heavy truck sales (less than 0.1% in 2020). By 2035, nearly all cars sold globally are electric, and by 2050 nearly all heavy trucks sold are fuel cell or electric. Low‐emissions fuels and behavioural changes help to reduce emissions in long‐distance transport, but aviation and shipping remain challenging and account for 330 Mt CO2 emissions in 2050.

In buildings, emissions drop by 40% to 2030 and more than 95% to 2050. By 2030, around 20% of the existing building stock worldwide is retrofitted and all new buildings comply with zero‐carbon‐ready building standards. Over 80% of the appliances sold are the most efficient models available by 2025 in advanced economies and by the mid‐2030s worldwide. There are no new fossil fuel boilers sold from 2025, except where they are compatible with hydrogen, and sales of heat pumps soar. By 2050, electricity provides 66% of energy use in buildings (33% in 2020). Natural gas use for heating drops by 98% in the period to 2050.

Biofuels

Several sustainability frameworks considering net lifecycle GHG emissions and other sustainability indicators exist in different regions, e.g. the Renewable Energy Directive II in the European Union, RenovaBio in Brazil and the Low‐C Fuel Standards in California. However, the scope, methodology and sustainability metrics of these frameworks differ.

Global consensus on a sustainability framework and indicators within the next few years would help stimulate investment; this should be a priority. Such a framework should cover all forms of bioenergy (liquid, gaseous and solid) and other low‐emissions fuels, and should strive for continuous environmental performance improvement. Certification schemes ideally should be developed in parallel.

Another early priority is for governments to assess national sustainable biomass feedstock potential as soon as possible to establish the quantities and types of wastes, residues and marginal lands suitable for energy crops. Assessments should provide the basis for national roadmaps for all liquid and gaseous biofuels, and strategies for low‐emissions fuels. Early decisions will be needed in this context about how to support the sustainable collection of wastes and residues from the forestry, agriculture, animal and food industries and from advanced municipal solid waste sorting systems: in the NZE, support measures are in place by 2025. Measures might usefully include low‐emissions fuels standards that incentivise the use of biofuels as feedstock. International knowledge‐sharing would help with the design of such measures and assist efficient dissemination of best practices from regions with existing collection systems, e.g. for forestry residues in Nordic countries and used cooking oil collection in Europe, China and Southeast Asia countries.

Energy and emission trends in the Net‐Zero Emissions Scenario

The global transport sector emitted over 7 Gt CO2 in 2020, and nearly 8.5 Gt in 2019 before the Covid‐19 pandemic.7 In the NZE, transport sector CO2 emissions are slightly over 5.5 Gt in 2030. By 2050 they are around 0.7 Gt – a 90% drop relative to 2020 levels. CO2 emissions decline even with rapidly rising passenger travel, which nearly doubles by 2050, and rising freight activity, which increases by two‐and‐a‐half‐times from current levels, and an increase in the global passenger car fleet from 1.2 billion vehicles in 2020 to close to 2 billion in 2050.

The transport modes do not decarbonise at the same rate because technology maturity varies markedly between them. CO2 emissions from two/three‐wheelers almost cease by 2040, followed by cars, vans and rail in the late 2040s. Emissions from heavy trucks, shipping and aviation fall by an annual average of 6% between 2020 and 2050, but still collectively amount to more than 0.5 Gt CO2 in 2050. This reflects projected activity growth and that many of the technologies needed to reduce CO2 emissions in long distance transport are currently under development and do not start to make substantial inroads into the market in the coming decade.

Decarbonisation of the transport sector in the NZE relies on policies to promote modal shifts

and more efficient operations across passenger transport modes, as well as improvements in energy efficiency. It also depends on two major technology transitions: shifts towards electric mobility (electric vehicles [EVs] and fuel cell electric vehicles [FCEVs]) and shifts towards higher fuel blending ratios and direct use of low‐carbon fuels (biofuels and hydrogen‐based fuels). These shifts are likely to require interventions to stimulate investment in supply infrastructure and to incentivise consumer uptake.

Transport sector

Transport has traditionally been heavily reliant on oil products, which accounted for more than 90% of transport sector energy needs in 2020 despite inroads from biofuels and electricity. In the NZE, the share of oil drops to less than 75% in 2030 and slightly over 10% by 2050. By the early 2040s, electricity becomes the dominant fuel in the transport sector worldwide in the NZE: it accounts for nearly 45% of total final consumption in 2050, followed by hydrogen‐based fuels (28%) and bioenergy (16%). Biofuels almost reach a 15% blending share in oil products by 2030 in road transport, which reduces oil needs by around 4.5 million barrels of oil equivalent per day (mboe/d). Beyond 2030, biofuels are increasingly used for aviation and shipping, where the scope for using electricity and hydrogen is more limited. Hydrogen carriers (such as ammonia) and low‐emissions synthetic fuels also supply increasing shares of energy demand in these modes.

Road vehicles

Electrification plays a central role in decarbonising road vehicles in the NZE. Battery cost declines of almost 90% in a decade have boosted sales of electric passenger cars by 40% on average over the past five years. Battery technology is already relatively commercially competitive. FCEVs start to make inroads in the 2020s in the NZE. The electrification of heavy trucks moves more slowly due to the weight of the batteries, high energy and power requirements required for charging, and limits on driving ranges. But fuel cell heavy trucks make significant progress, mainly after 2030. The number of battery electric, plug‐in hybrid and fuel cell electric light‐duty vehicles (cars and vans) on the world’s roads reaches 350 million in 2030 and almost 2 billion in 2050, up from 11 million in 2020. The number of electric two/three‐wheelers also rises rapidly, from just under 300 million today to 600 million in 2030 and 1.2 billion in 2050. The electric bus fleet expands from 0.5 million in 2020 to 8 million in 2030 and 50 million in 2050.

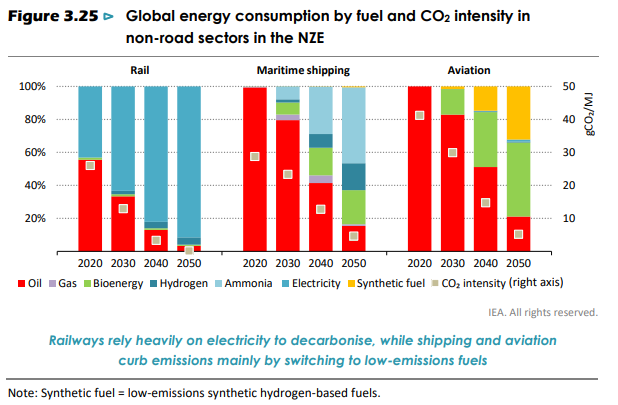

Aviation

The NZE assumes that air travel, measured in revenue‐passenger kilometres, increases by only around 3% per year to 2050 relative to 2020. This compares with about around 6% over the 2010‐19 period. The NZE assumes that aviation growth is constrained by comprehensive government policies that promote a shift towards high‐speed rail and rein in expansion of long‐haul business travel, e.g. through taxes on commercial passenger flights (see section 2.5.2). Global CO2 emissions from aviation rise in the NZE from about 640 Mt in 2020 (down from around 1 Gt in 2019) to a peak of 950 Mt by around 2025. Emissions then fall to 210 Mt in 2050 as the use of low‐emissions fuels grows. Emissions are hard to abate because aviation requires fuel with a high energy density. Emissions in aviation comprise just over 10% of unabated CO2 emissions from fossil fuels and industrial processes in 2050.

Maritime shipping

Maritime shipping was responsible for around 830 Mt CO2 emissions worldwide in 2020 (880 Mt CO2 in 2019), which is around 2.5% of total energy sector emissions. Due to a lack of available low‐carbon options on the market and the long lifetime of vessels (typically 25‐35 years), shipping is one of the few transport modes that does not achieve zero emissions by 2050 in the NZE. Nevertheless, emissions from shipping decline by 6% annually to 120 Mt CO2 in 2050.

In the short term, there is considerable potential for curbing fuel consumption in shipping through measures to optimise operational efficiency and improve energy efficiency. Such approaches include slow steaming and the use of wind‐assistance technologies (IEA, 2020b). In the medium to long term, significant emissions reductions are achieved in the NZE by switching to low‐carbon fuels such as biofuels, hydrogen and ammonia. Ammonia looks likely to be a particularly good candidate for scaling up, and a critical fuel for long‐range transoceanic journeys that need fuel with high energy density.

Ammonia and hydrogen are the main low‐carbon fuels for shipping adopted over the next three decades in the NZE, their combined share of total energy consumption in shipping reaching around 60% in 2050. The 20 largest ports in the world account for more than half of global cargo (UNCTAD, 2018); they could become industrial hubs to produce hydrogen and ammonia for use in both chemical and refining industries, as well as for refuelling ships.

Internal combustion engines for ammonia‐fuelled vessels are currently being developed by two of the largest manufacturers of maritime engines and are expected to become available on the market by 2024. Sustainable biofuels provide almost 20% of total shipping energy needs in 2050. Electricity plays a very minor role, as the relatively low energy density of batteries compared with liquid fuels makes it suitable only for shipping routes of up to 200 km. Even with an 85% increase in battery energy density in the NZE as solid-state batteries come to market, only short‐distance shipping routes can be electrified.

Rail

Rail transport is the most energy‐efficient and least carbon‐intensive way to move people and second only to shipping for carrying goods. Passenger rail almost doubles its share of total transport activity to 20% by 2050 in the NZE, with particularly rapid growth in urban and high‐speed rail (HSR), the latter of which contributes to curbing growth in air travel.

Global CO2 emissions from the rail sector fall from 95 Mt CO2 in 2020 (100 Mt CO2 in 2019) to almost zero by 2050 in the NZE, driven primarily by rapid electrification.

In the NZE, all new tracks on high‐throughput corridors are electrified from now on, while hydrogen and battery electric trains, which have recently been demonstrated in Europe, are adopted on rail lines where throughput is too low to make electrification economically viable. Oil use, which accounted for 55% of total energy consumption in the rail sector in 2020, falls to almost zero in 2050: it is replaced by electricity, which provides over 90% of rail energy needs and by hydrogen which provides another 5%.

Wider Application of achieving net-zero emissions

- Economy: In our Net‐Zero Emissions by 2050 Scenario (NZE), global CO2 emissions reach net zero by 2050 and investment rises across electricity, low‐emissions fuels, infrastructure and end‐use sectors. Clean energy employment increases by 14 million to 2030, but employment in oil, gas and coal declines by around 5 million. There are varying results for different regions, with job gains not always occurring in the same place, or matching the same skill set, as job losses. The increase in jobs and investment stimulates economic output, resulting in a net increase in global GDP to 2030. But oil and gas revenues in producer economies are 80% lower in 2050 than in recent years and tax revenues from retail oil and gas sales in importing countries are 90% lower.

- Energy industry: There is a major contraction in fossil fuel production, but companies that produce these fuels have skills and resources that could play a key role in developing new low‐emissions fuels and technologies. The electricity industry scales up to meet demand rising over two‐and‐a‐half‐fold to 2050 and becomes more capital intensive, focusing on renewables, sources of flexibility and grids. Large energy‐consuming companies, vehicle manufacturers and their suppliers adjust designs and retool factories while improving efficiency and switching to alternative fuel supplies.

- For citizens who lack access to electricity and clean cooking, the NZE delivers universal access by 2030. This costs around USD 40 billion a year over the next decade and adds less than 0.2% to CO2 emissions. For citizens the world over, the NZE brings profound changes, and their active support is essential if it is to succeed. Around three‐quarters of behavioural changes in the NZE can be directly influenced or mandated by government policies. The cost of energy is also an important issue for citizens, and the proportion of disposable household income spent on energy over the period to 2050 remains stable in emerging market and developing economies, despite a large increase in demand for modern energy services.

- Government action is central to achieve net‐zero emissions globally by 2050; it underpins the decisions made by all other actors. Four particular points are worth stressing. First, the NZE depends on actions that go far beyond the remit of energy ministers, and requires a co‐ordinated cross‐government approach. Second, the fall in oil and gas demand in the NZE may reduce some traditional energy security risks, but they do not disappear, while potential new vulnerabilities emerge from increasing reliance on electricity systems and critical minerals. Third, accelerated innovation is needed. The emissions cuts to 2030 in the NZE can be mostly achieved with technologies on the market today, but almost half of the reductions in 2050 depend on technologies that are currently under development. Fourth, an unprecedented level of international co‐operation is needed. This helps to accelerate innovation, develop international standards and facilitate new infrastructure to link national markets. Without the co‐operation assumed in the NZE, the transition to net‐zero emissions would be delayed by decades.

Energy industry

- Oil and gas

The energy transition envisioned in the NZE involves a major contraction of oil and gas production with far‐reaching implications for all the companies that produce these fuels. Oil demand falls from around 90 million barrels per day (mb/d) in 2020 to 24 mb/d in 2050, while natural gas demand falls from 3 900 billion cubic metres (bcm) to around 1 700 bcm. No fossil fuel exploration is required in the NZE as no new oil and natural gas fields are required beyond those that have already been approved for development. This represents a clear threat to company earnings, but there are also opportunities. The resources and skills of the oil and gas industry are a good match with some of the new technologies needed to tackle emissions in sectors where reductions are likely to be most challenging, and to produce some of the low‐emissions liquids and gases for which there is a rapid increase in demand in the NZE . By partnering with governments and other stakeholders, the oil and gas industry could play a leading role in developing these fuels and technologies at scale, and in establishing new business models.

The oil and gas industry is highly diverse, and various companies could pursue very different strategies in the transition to net‐zero emissions. Minimising emissions from core oil and gas operations however should be a first‐order priority for all oil and gas companies. This includes tackling methane emissions that occur during operations (they fall by 75% between 2020 and 2030 in the NZE) and eliminating flaring. Companies should also electrify operations using renewable electricity wherever possible, either by purchasing electricity from the grid or by integrating off‐grid renewable energy sources into upstream facilities or transport infrastructure. Producers that can demonstrate strong and effective action to reduce emissions can credibly argue that their oil and gas resources should be preferred over higher emissions options.

Some oil and gas companies may choose to become “energy companies” focused on low‐emissions technologies and fuels, including renewable electricity, electricity distribution, EV charging and batteries. Several technologies that are critical to the achievement of net‐zero emissions, such as CCUS, hydrogen, bioenergy and offshore wind, look especially well‐suited to some of the existing skills, competencies and resources of oil and gas companies.

- Carbon capture, utilisation and storage. The oil and gas industry is already the global leader in developing and deploying CCUS. Of the 40 million tonnes (Mt) of CO2 captured today at large‐scale facilities, around three‐quarters is captured from oil and gas operations, which often produce concentrated streams of CO2 that are relatively easy and cost effective to capture (IEA, 2020c). The oil and gas industry also has the large‐scale engineering, pipeline, sub‐surface and project management skills and capabilities to handle large volumes of CO2 and to help scale up the deployment of CCUS.

- Low‐emissions hydrogen and hydrogen‐based fuels. Oil and gas companies could contribute to developing and deploying low‐emissions hydrogen in several ways (IEA, 2019a). Nearly 40% of hydrogen production in 2050 in the NZE is from natural gas in facilities equipped with CCUS, providing an important opportunity for companies and countries to utilise their natural gas resources in a way that is consistent with net‐zero emissions. Of the total output of 530 Mt of hydrogen in 2050, about 30% is processed into ammonia and synthetic fuels (equivalent to around 7.5 mboe/d). The transformation processes involved have many potential synergies with the skills and equipment used in oil and gas processing and refining. Oil and gas companies also have long experience of transporting liquids and gases by pipeline and ships.

- Advanced biofuels and biomethane. The production of advanced biofuels grows substantially in the NZE, but this depends critically on continued technological innovation. Many oil and gas companies have active R&D programmes in these areas and could become leading producers. Biomethane – a low‐emissions alternative to natural gas – can be produced in large centralised facilities, which could be a good fit with the knowledge and technical expertise of existing gas producers (IEA, 2020d).

- Offshore wind. About 40% of the lifetime costs of a standard offshore wind project involve significant synergies with the offshore oil and gas sector (IEA, 2019b). The oil and gas industry has considerable experience of working in offshore locations, which could be of value in the construction of foundations and subsea structures for offshore wind farms, especially when using vessels during installation and operation. The experience of maintaining safety standards in oil and gas companies could also be helpful during maintenance and inspection of offshore wind farms once they are in operation.

Oil and gas companies are well‐placed to accelerate the pace of development and deployment of these technologies, and to gain a commercial edge over other companies. In the NZE, investment in low‐emissions technologies suited to the skills and expertise of oil and gas companies exceeds that in traditional oil and gas operations by 2030. Total capital spending on these technologies and on traditional oil and gas operations averages USD 650 billion per year over 2021‐50, just less than annual investment in oil and gas projects between 2016 and 2020.

Not all oil and gas companies will choose to follow a strategy of diversifying into other types of energy. For example, it is far from certain that national oil companies will be charged by their state owners to diversify and develop low‐emissions energy sources outside their core area of activity; other companies may decide simply to concentrate on supplying oil and natural gas as cleanly and efficiently as possible, and to return income to shareholders. What is clear, however, is that no oil and gas company would be unaffected by the NZE and that all parts of the industry need to decide how to respond (IEA, 2020e).

Infrastructure

Getting to net‐zero emissions will require huge amounts of new infrastructure and lots of modifications to existing assets. Energy infrastructure is transformed in the NZE as all countries and regions move from systems supporting the use of fossil fuels and the distribution of conventionally generated electricity to systems based largely on renewable electricity and low‐emissions fuels. In many emerging market and developing economies, the provision of large amounts of infrastructure would be necessary in the coming decades in any case, creating a window of opportunity to support the transition to a net‐zero emissions economy. In all countries, governments will play a central role in planning, financing and regulating the development of infrastructure. Some of the main infrastructure components

– electricity networks and EV charging, pipelines systems for low‐emissions fuels and CO2, and transport infrastructure – are discussed below.

The rapid increase in electricity demand in the NZE and the transition to renewable energy call for an expansion and modernisation of electricity networks. This would require a sharp reversal in the recent trend of declining investment: failure to achieve this would almost certainly make the energy transition for net‐zero emissions impossible. Tariff design and permitting procedures also need to be revised to reflect fundamental changes in the provision and uses of electricity. Some of the main considerations include:

- Long‐distance transmission. Most of the growth in renewables in the NZE comes from centralised sources. Yet the best solar and wind resources are often in remote regions, requiring new transmission connections. Ultra-high‐voltage direct current systems are likely to play an important role in supporting transmission over long distances.

- Local distribution. Energy efficiency gains in households and wider use of rooftop solar PV mean surplus electricity will be available more often, while electric heat pumps and residential EV charging points will require electricity to be more widely available.

Together these developments point to the need for substantial increases in distribution network capacity.

- Grid substations. The massive expansion of solar PV and wind requires new grid substations: their capacity expands by more than 57 000 GW in the NZE by 2030, doubling current capacity globally.

- EV charging. Major new public charging networks are built in the NZE, including in work places, highway service stations and residential complexes, to support EV expansion and long‐distance driving on highways.

- Digitalisation of networks. With a large increase in the use of connected devices, the digitalisation of grid assets supports more flexible grid operations, better management of variable renewables and more efficient demand response.

Pipelines continue to play a key role in the transmission and distribution of energy in the NZE:

- Given the rapid decline of fossil fuels, significant investment in new oil and gas pipelines are not needed in the NZE. However, investment is needed to link the production of low‐emissions liquids and gases with consumption centres, and to convert existing pipelines and associated distribution infrastructure for the use of these low‐emissions fuels. Some low‐emissions fuels, such as biomethane and synthetic hydrogen‐based fuels, can make use of existing infrastructure without any modifications, but pure hydrogen requires a retrofit of existing pipelines. New dedicated hydrogen infrastructure is also needed in the NZE, for example to move hydrogen produced in remote areas with excellent renewable resources to demand centres.

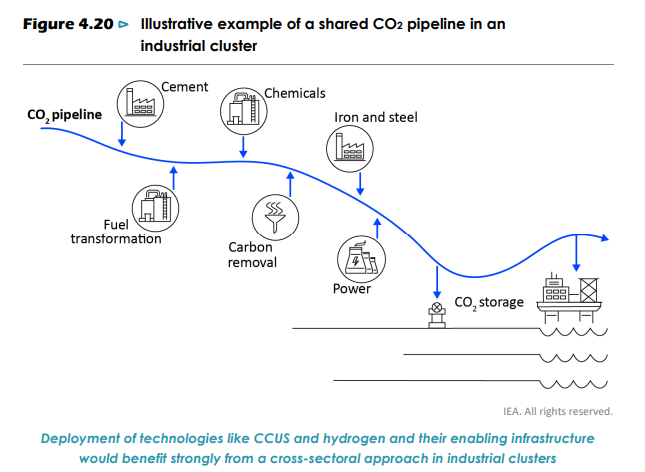

- The expansion of CCUS in the NZE requires investment in CO2 transport and storage capacity. By 2050, 7.6 Gt of CO2 is captured worldwide, requiring a large amount of pipeline and shipping infrastructure linking the facilities where CO2 is captured with storage sites. Industrial clusters, including ports, may offer the best near‐term opportunities to build CO2 pipeline and hydrogen infrastructure, as the various industries in those clusters using the new infrastructure would be able to share the upfront investment needs.

Governments drive innovation in the NZE

Bringing new energy technologies to market can often take several decades, but the imperative of reaching net‐zero emissions globally by 2050 means that progress has to be much faster. Experience has shown that the role of government is crucial in shortening the time needed to bring new technology to market and to diffuse it widely (IEA, 2020i). The government role includes educating people, funding R&D, providing networks for knowledge exchange, protecting intellectual property, using public procurement to boost deployment, helping companies innovate, investing in enabling infrastructure and setting regulatory frameworks for markets and finance.

Knowledge transfer from first‐mover countries can also help in the acceleration needed, and is particularly important in the early phases of adoption when new technologies are typically not competitive with incumbent technologies. For example, in the case of solar PV, national laboratories played a key role in the early development phase in the United States, projects supported directly by government in Japan created market niches for initial deployment and government procurement and incentive policies in Germany, Italy, Spain, United States, China, Australia and India fostered a global market. Lithium‐ion (Li‐ion) batteries were initially developed through public and private research that took place mostly in Japan, their first energy‐related commercial operation was made possible in the United States, and mass manufacturing today is primarily in China.

Many of the biggest clean energy technology challenges could benefit from a more targeted approach to speed up progress (Diaz Anadon, 2012; Mazzucato, 2018). In the NZE, concerted government action leverages private sector investment and leads to advances in clean energy technologies that are currently at different stages of development.

International co-operation

The pathway to net‐zero emissions by 2050 will require an unprecedented level of international co‐operation between governments. This is not only a matter of all countries participating in efforts to meet the net zero goal, but also of all countries working together in an effective and mutually beneficial manner. Achieving net‐zero emissions will be extremely challenging for all countries, but the challenges are toughest and the solutions least easy to deliver in lower income countries, and technical and financial support will be essential to ensure the early stage deployment of key mitigation technologies and infrastructure in many of these countries. Without international co‐operation, emissions will not fall to net zero by 2050.

There are four aspects of international co‐operation that are particularly important (Victor, Geels and Sharpe, 2019).

- International demand signals and economies of scale. International co‐operation has been critical to the cost reductions seen in the past for many key energy technologies.

It can accelerate knowledge transfer and promote economies of scale. It can also help align the creation of new demand for clean energy technologies and fuels in one region with the development of supply in other regions. These benefits need to be weighed against the importance of creating domestic jobs and industrial capacities, and of ensuring supply chain resilience.

- Managing trade and competitiveness. Industries that operate in a number of countries need standardisation to ensure inter‐operability. Progress on innovation and clean energy technology deployment in sectors such as heavy industry has been inhibited in the past by uncoordinated national policies and a lack of internationally agreed standards. The development of such standards could accelerate energy technology development and deployment.

- Innovation, demonstration and diffusion. Clean energy R&D and patenting is currently concentrated in a handful of places: United States, Europe, Japan, Korea and China accounted for more than 90% of clean energy patents in 2014‐18. Progress towards net‐zero emissions would be increased by moving swiftly to extend experience and knowledge of clean energy technologies in countries that are not involved in their initial development, and by funding first‐of‐a‐kind demonstration projects in emerging market and developing economies. International programmes to fund demonstration projects, especially in sectors where technologies are large and complex, would accelerate the innovation process (IEA, 2020i).

- Carbon dioxide removal (CDR) programmes. CDR technologies such as bioenergy and DAC equipped with CCUS are essential to provide emissions reductions at a global level.

International co‐operation is needed to fund and certify these programmes, so as to make the most of suitable land, renewable energy potential and storage resources, wherever they may be. International emissions trading mechanisms could play a role in offsetting emissions in some sectors or areas with negative emissions, though any such mechanisms would require a high degree of co‐ordination to ensure market functioning and integrity.

The NZE assumes that international co‐operation policies, measures and efforts are introduced to overcome these hurdles. To explore the potential implications of a failure to do so, we have devised a Low International Co‐operation Case. This examines what would happen if national efforts to mitigate climate change ramp up in line with the level of effort in the NZE but co‐operation frameworks are not developed at the same speed. It shows that the lack of international co‐operation has a major impact on innovation, technology demonstration, market co‐ordination and ultimately on the emissions pathway.

Framing the Low International Co-operation Case

Hydrogen roadmap for Europe

The IPCC ‘Special Report on the impacts of global warming of 1.5 °C above pre-industrial levels and related global greenhouse gas emission pathways’ (IPCC, 2018) provides an exhaustive assessment of the modelling work that may help to estimate the residual CO2 budget consistent with the Paris Agreement goals.

The EU has to maintain and increase its leadership in research and innovation for developing zero-carbon solutions towards a sustainable planet, so as to maintain its leadership in climate action.

Research and innovation investments are the best way to address the decarbonisation challenge while also ensuring European industrial and economic leadership.

The guiding key principles that were proposed in the introduction to develop a EU strategy for research and innovation in the zero-carbon domain and to summarise some of the evidence presented in earlier chapters with respect to each principle:

- Engage in a race to the top in innovation for decarbonisation, searching for new alternatives.

- Give priority to zero-carbon solutions that have the potential to be developed and deployed within the 2050 timeframe.

- Explore and develop portfolios of zero-carbon technologies, promoting diversification, and reducing the risk of too early and risky choices.

- Emphasise system-level innovation, promoting sector coupling, so that the individual elements of decarbonisation fit together in a coherent whole.

- Focus investments in the high added-value segments of value chains.

- Engage in smart international cooperation for zero-carbon innovation.

2.2.2.1 Greenhouse gas emission

Towards a Hydrogen Ecosystem in Europe.

Hydrogen may be produced through a variety of processes. These production pathways are associated with a wide range of emissions, depending on the technology and energy source used and have different costs implications and material requirements. In this Communication:

- ‘Electricity-based hydrogen’ refers to hydrogen produced through the electrolysis of water (in an electrolyser, powered by electricity), regardless of the electricity source. The full life-cycle greenhouse gas emissions of the production of electricity-based hydrogen depends on how the electricity is produced.

- ‘Renewable hydrogen’ is hydrogen produced through the electrolysis of water (in an electrolyser, powered by electricity), and with the electricity stemming from renewable sources. The full life-cycle greenhouse gas emissions of the production of renewable hydrogen are close to zero. Renewable hydrogen may also be produced through the reforming of biogas (instead of natural gas) or biochemical conversion of biomass, if in compliance with sustainability requirements.

- ‘Clean hydrogen’ refers to renewable hydrogen.

- ‘Fossil-based hydrogen’ refers to hydrogen produced through a variety of processes using fossil fuels as feedstock, mainly the reforming of natural gas or the gasification of coal. This represents the bulk of hydrogen produced today. The life-cycle greenhouse gas emissions of the production of fossil-based hydrogen are high.

- ‘Fossil-based hydrogen with carbon capture’ is a subpart of fossil-based hydrogen, but where greenhouse gases emitted as part of the hydrogen production process are captured. The greenhouse gas emissions of the production of fossil-based hydrogen with carbon capture or pyrolysis are lower than for fossil-fuel based hydrogen, but the variable effectiveness of greenhouse gas capture (maximum 90%) needs to be taken into account.

- ‘Low-carbon hydrogen’ encompasses fossil-based hydrogen with carbon capture and electricity-based hydrogen, with significantly reduced full life-cycle greenhouse gas emissions compared to existing hydrogen production.

- ‘Hydrogen-derived synthetic fuels’ refer to a variety of gaseous and liquid fuels on the basis of hydrogen and carbon. For synthetic fuels to be considered renewable, the hydrogen part of the syngas should be renewable. Synthetic fuels include for instance synthetic kerosene in aviation, synthetic diesel for cars, and various molecules used in the production of chemicals and fertilisers. Synthetic fuels can be associated with very different levels of greenhouse gas emissions depending on the feedstock and process used. In terms of air pollution, burning synthetic fuels produces similar levels of air pollutant emissions than fossil fuels.

Today, neither renewable hydrogen nor low-carbon hydrogen, notably fossil-based hydrogen with carbon capture, are cost-competitive against fossil-based hydrogen. Estimated costs today for fossil-based hydrogen are around 1.5 €/kg for the EU, highly dependent on natural gas prices, and disregarding the cost of CO2.

2.2.2.2 Road Map Priority

The priority for the EU is to develop renewable hydrogen, produced using mainly wind and solar energy. Renewable hydrogen is the most compatible option with the EU’s climate neutrality and zero pollution goal in the long term and the most coherent with an integrated energy system. The choice for renewable hydrogen builds on European industrial strength in electrolyser production, will create new jobs and economic growth within the EU and support a cost-effective integrated energy system. On the way to 2050, renewable hydrogen should progressively be deployed at large scale alongside the roll-out of new renewable power generation, as technology matures and the costs of its production technologies decrease. This process must be initiated now.

In the short and medium term, however, other forms of low-carbon hydrogen are needed, primarily to rapidly reduce emissions from existing hydrogen production and support the parallel and future uptake of renewable hydrogen.

The hydrogen ecosystem in Europe is likely to develop through a gradual trajectory, at different speeds across sectors and possibly across regions and requiring different policy solutions.

In the first phase, from 2020 up to 2024, the strategic objective is to install at least 6 GW of renewable hydrogen electrolysers in the EU and the production of up to 1 million tonnes of renewable hydrogen, to decarbonise existing hydrogen production, e.g. in the chemical sector and facilitating take up of hydrogen consumption in new end-use applications such as other industrial processes and possibly in heavy-duty transport.

In this phase, manufacturing of electrolysers, including large ones (up to 100 MW), needs to be scaled up. These electrolysers could be installed next to existing demand centres in larger refineries, steel plants, and chemical complexes. They would ideally be powered directly from local renewable electricity sources. In addition, hydrogen refuelling stations will be needed for the uptake of hydrogen fuel-cell buses and at a later stage trucks. Electrolysers will thus also be needed to locally supply an increasing number of hydrogen refuelling stations.

Different forms of low-carbon electricity-based hydrogen, especially those produced with near zero greenhouse gas emissions, will contribute to scale up production and the market for hydrogen. Some of the existing hydrogen production plants should be decarbonised by retrofitting them with carbon capture and storage technologies.

Infrastructure needs for transporting hydrogen will remain limited as demand will be met initially by production close or on site and in certain areas blending with natural gas might occur, but planning of medium range and backbone transmission infrastructure should begin.

Infrastructure for carbon capture and use of CO2 will be required to facilitate certain forms of low-carbon hydrogen.

The policy focus will be on laying down the regulatory framework for a liquid and well-functioning hydrogen market and on incentivising both supply and demand in lead markets, including through bridging the cost gap between conventional solutions and renewable and low-carbon hydrogen and through appropriate State aid rules. Enabling framework conditions will push concrete plans for large wind and solar plants dedicated to gigawatt-scale renewable hydrogen production before 2030.

The European Clean Hydrogen Alliance will help build up a robust pipeline of investments.

As part of the Commission’s recovery plan, funding instruments of Next Generation EU, including the Strategic European Investment Window of the InvestEU programme and the ETS Innovation Fund, will enhance the funding support and help bridge the investment gap for renewables generated by the COVID-19 crisis.

In a second phase, from 2025 to 2030, hydrogen needs to become an intrinsic part of an integrated energy system with a strategic objective to install at least 40 GW of renewable hydrogen electrolysers by 2030 and the production of up to 10 million tonnes of renewable hydrogen in the EU.

In this phase, renewable hydrogen is expected to gradually become cost-competitive with other forms of hydrogen production, but dedicated demand side policies will be needed for industrial demand to gradually include new applications, including steel-making, trucks, rail and some maritime transport applications, and other transport modes. Renewable hydrogen will start playing a role in balancing a renewables-based electricity system by transforming electricity into hydrogen when renewable electricity is abundant and cheap and by providing flexibility. Hydrogen will also be used for daily or seasonal storage, as a backup and provide buffering functions30, enhancing security of supply in the medium term.

Additionally, the further retrofitting of existing fossil-based hydrogen production with carbon capture should continue to reduce greenhouse gas and other air pollutant emissions in view of the increased 2030 climate ambition.

Local hydrogen clusters, such as remote areas or islands, or regional ecosystems – so-called “Hydrogen Valleys” – will develop, relying on local production of hydrogen based on decentralised renewable energy production and local demand, transported over short distances. In such cases, a dedicated hydrogen infrastructure can use hydrogen not only for industrial and transport applications, and electricity balancing, but also for the provision of heat for residential and commercial buildings.

In this phase, the need for an EU-wide logistical infrastructure will emerge, and steps will be taken to transport hydrogen from areas with large renewable potential to demand centres located possibly in other Member States. The back-bone of a pan-European grid will need to be planned and a network of hydrogen refuelling stations to be established. The existing gas grid could be partially repurposed for the transport of renewable hydrogen over longer distances and the development of larger-scale hydrogen storage facilities would become necessary. International trade can also develop, in particular with the EU’s neighbouring countries in Eastern Europe and in the Southern and Eastern Mediterranean countries.

European Hydrogen Backbone

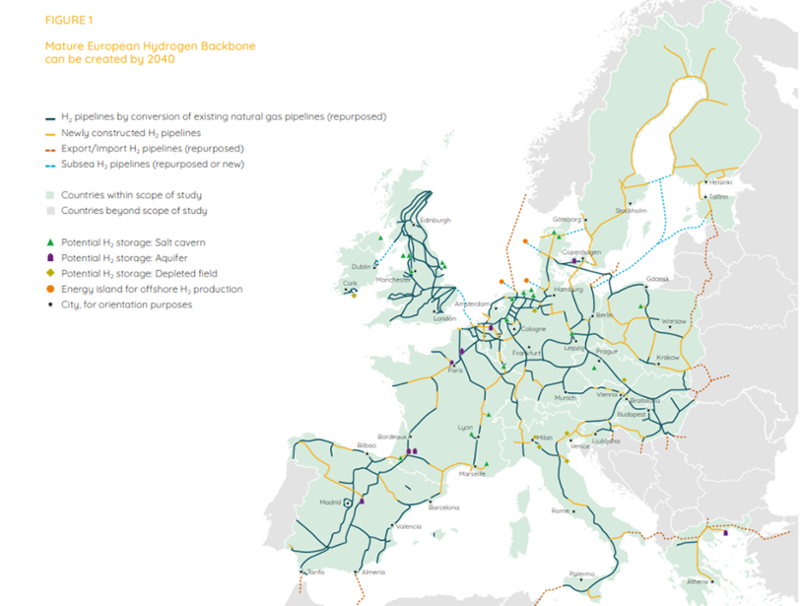

In April 2021, the European Hydrogen Backbone, a Gas for Climate endorsed initiative, launched an updated plan for a dedicated hydrogen transport infrastructure, showing that existing gas infrastructure can be retrofitted to transport hydrogen at an affordable cost.

The plan foresees a network gradually emerging from the mid-2020s onwards, towards an initial pipeline network by 2030 connecting ‘hydrogen valleys’. By 2040, a hydrogen network of almost 40,000km is foreseen, 69% of which will consist of converted natural gas pipelines, connected by new pipeline stretches. The European network can be used for large-scale hydrogen transport over longer distances in an energy-efficient way, also taking into consideration hydrogen imports.

Creating this hydrogen backbone has an estimated investment cost of €43 to €81 billion.

The levelised cost of transport is estimated to be between €0.11-0.21 per kg of hydrogen per 1,000 km, allowing hydrogen to be cost-efficiently transported over long distances across Europe.

The relatively wide range in the estimate is mainly due to uncertainties in (location-dependent) compressor costs.

Mature European Hydrogen Backbone in 2040

In terms of policy focus, such a sustained scale up over a relatively short period will require gearing up EU’s support and stimulate investments to build a fully-fledged hydrogen ecosystem. By 2030 the EU will aim at completing an open and competitive EU hydrogen market, with unhindered cross-border trade and efficient allocation of hydrogen supply among sectors.

In a third phase, from 2030 onwards and towards 2050, renewable hydrogen technologies should reach maturity and be deployed at large scale to reach all hard-to decarbonise sectors where other alternatives might not be feasible or have higher costs.

In this phase, renewable electricity production needs to massively increase as about a quarter of renewable electricity might be used for renewable hydrogen production by 2050.

In particular, hydrogen and hydrogen-derived synthetic fuels, based on carbon neutral CO2, could penetrate more largely across a wider range of sectors of the economy, from aviation and shipping to hard-to-decarbonise industrial and commercial buildings. Sustainable biogas may also have a role in replacing natural gas in hydrogen production facilities with carbon capture and storage to create negative emissions, at the condition that biomethane leakage is avoided and only in line with the biodiversity objectives and the principles stated in the EU2030 Biodiversity Strategy.

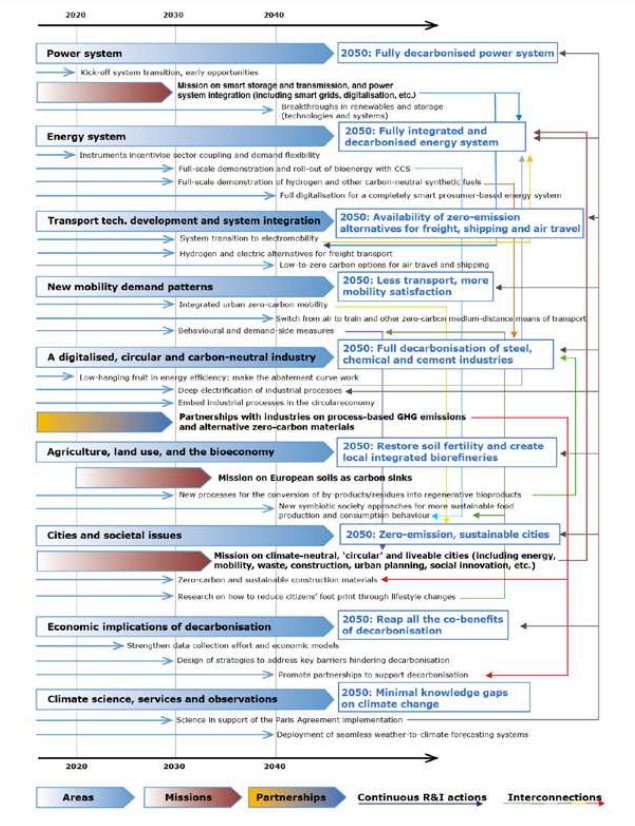

Proposed priority research and innovation actions for supporting the decarbonisation process in different areas in the timeframe 2018-2040, in order to achieve the 2050 goals indicated in the boxes. Red arrows represent Horizon Europe mission-oriented actions; yellow-brown arrows represent Horizon Europe public-private partnerships. All linear arrows are intended as roadmaps that produce various outputs throughout their timeframe until their end-date, when the activity should be completed and deployed in society. Many of the proposed actions are interrelated, and their results contribute to different 2050 goals

Green Alliances and Partnerships

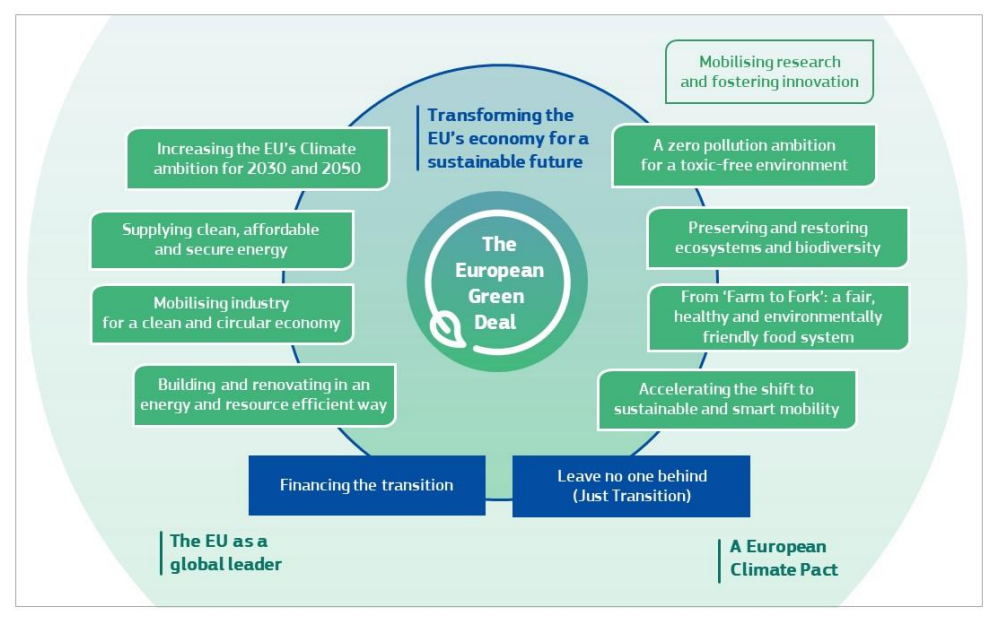

The EU is at the forefront of international efforts to promote economically, environmentally and socially sustainable development to address the planetary crisis and in particular to fight climate change. The European Green Deal is Europe’s structural response and new growth strategy that sets out ambitions to transform the EU into a modern, resource-efficient and competitive economy where:

- There are no net emissions of greenhouse gases by 2050;

- Economic growth is decoupled from resource use;

- Natural capital is protected, sustainably managed and restored

- The health and well-being of citizens is protected from environment-related risks and impacts;

- No person and no place is left behind.

As a global leader, the EU will continue to lead international efforts, and in conjunction with our partners, address environmental challenges and promote the implementation of ambitious environment, climate and energy policies across the world.

The Green Deal is an integral part of this Commission’s strategy to implement the United Nation’s 2030 Agenda and the sustainable development goals , and the other priorities announced in President von der Leyen’s political guidelines. As part of the Green Deal, the Commission will refocus the European Semester process of macroeconomic coordination to integrate the United Nations’ sustainable development goals, to put sustainability and the well-being of citizens at the centre of economic policy, and the sustainable development goals at the heart of the EU’s policymaking and action.

The figure below illustrates the various elements of the Green Deal.

Delivering the European Gren Deal:

- Transforming our economy and societies

- Making transport sustainable for all

- Leading the third industrial revolution

- Cleaning our energy system

- Renovating buildings for greener lifestyles

- Working with nature to protect our planet and health

- Boosting global climate action

For details see European Commission web page : https://ec.europa.eu/info/strategy/priorities-2019-2024/european-green-deal/delivering-european-green-deal_en#:~:text=Making%20Europe%20the%20first%20climate,cost%20effective%20and%20competitive%20way.

US ROAD MAP

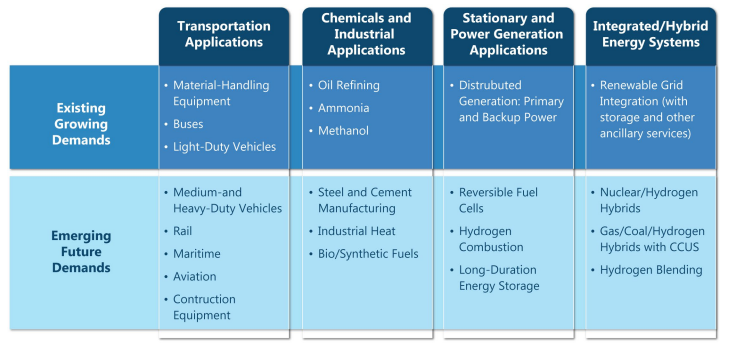

Hydrogen Overview & Needs

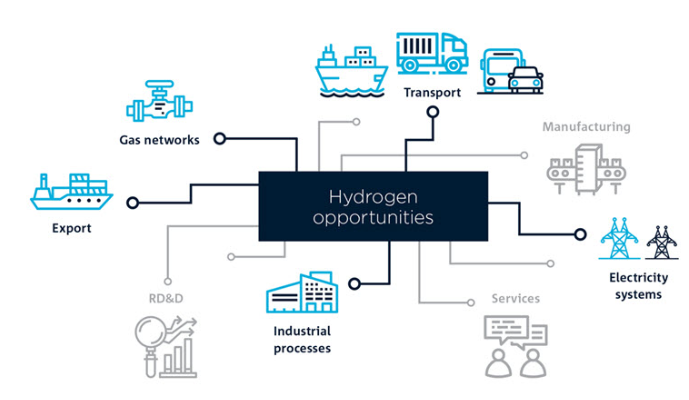

As shown in Figure 1, there are a wide range of applications where the use of hydrogen is either growing or has the potential for significant future demand. These diverse applications highlight the scale of the technical potential for hydrogen and related technologies. And this potential is being recognized worldwide, with investments by government and industry ramping up in many countries. Industry has projected a potential $2.5 trillion global market for hydrogen technologies by 2050,18 and annual shipments of fuel cells have increased 15-fold since 2015, now at over. For the first time, a coalition of major industries teamed together to develop an industry-led roadmap on the potential for hydrogen in the United States. The roadmap report concludes that by 2050, the U.S. hydrogen economy could lead to an estimated $750 billion per year in revenue and a cumulative 3.4 million jobs. Industry is starting to invest in large-scale hydrogen projects in multiple regions.

Examples include hydrogen production, storage, and end use in turbines through the $1 billion Advanced Clean Energy Storage project in Utah a 5 MW electrolyzer project planned in Washington State; first-of-a-kind nuclear-to-hydrogen projects in multiple states; and a 20 MW electrolyzer plant to produce hydrogen from solar power in Florida.

Over the past 40 years, hydrogen and related technologies, such as fuel cells and turbines, have transitioned from highly specialized applications to commercially available products. Thousands of fuel cells are already in use in passenger and commercial vehicles, forklifts, and stationary and backup power units throughout the United States. The number of retail hydrogen fueling stations has grown to approximately 45 over the past few years and over 145 when including infrastructure for niche markets in material handling. In power generation, advances have led to commercialization of large-frame turbines that can fire hydrogen/natural gas blends. Much of this transition has been enabled by R&D advances from DOE. Over the past 20 years, DOE has invested more than $4 billion in a number of hydrogen and related areas, including hydrogen production from diverse domestic sources, hydrogen delivery and storage, and conversion technologies including fuel cells and turbines. These research efforts, in collaboration with industry, have resulted in a number of successes such as advanced production systems capable of producing carbon-free hydrogen for less than $2 per kg with carbon capture and storage. DOE funded R&D has also reduced the cost of transportation fuel cells by 60% and quadrupled durability, and has resulted in over 1,100 U.S. patents issued and over 30 commercial technologies in the market.

The key technical challenges for hydrogen and related technologies are cost, durability, reliability, and performance, as well as the lack of hydrogen infrastructure. To achieve widespread commercialization, hydrogen utilization technologies must enter larger markets and be able to compete with incumbent technologies in terms of life-cycle cost, performance, durability, and environmental impact. Non-technical barriers also need to be addressed, such as developing and harmonizing codes and standards, fostering best practices for safety, and developing a robust supply chain and workforce.

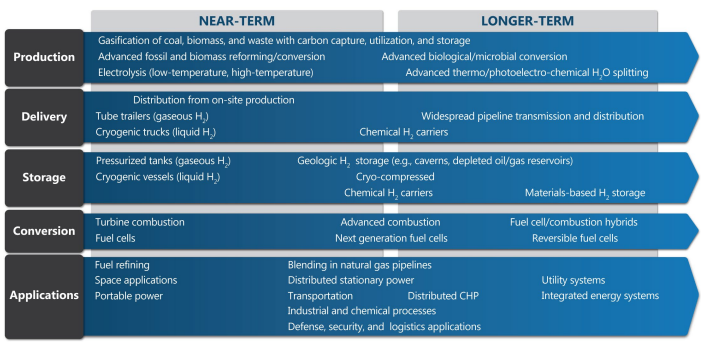

Over the years, a number of technology options have been discovered and developed to meet key needs in each technical area, and substantial progress has been made in many of them. As shown in Figure, these options span the full spectrum of near- to longer-term large-scale market adoption. The expected timeframe for adoption is based both on technology maturity and expected demand. Some technologies may be technologically mature but have not yet developed sufficient demand for widespread adoption.

DOE Hydrogen Program

The mission of the DOE Hydrogen Program is to research, develop, and validate transformational hydrogen and related technologies including fuel cells and turbines, and to address institutional and market barriers, to ultimately enable adoption across multiple applications and sectors.

Development of hydrogen energy from diverse domestic resources will ensure that the United States has an abundant, reliable, and affordable supply of clean energy to maintain the nation’s prosperity throughout the 21st century and beyond.

To accomplish this mission, the Program works in partnership with industry, academia, national laboratories, federal and international agencies, and other stakeholders to:

- Overcome technical barriers through basic and applied research and development

- Integrate, demonstrate, and validate “first-of-a-kind” hydrogen and related technologies

- Accelerate the transition of innovations and technologies to the private sector

- Address institutional issues including safety concerns, education and workforce development, and the development of codes and standards

- Identify, implement, and refine appropriate strategies for Federal programs to catalyze a sustainable market and concomitant benefits to the economy, the environment, and energy security

In addition to participation from EERE, FE, NE, OE, and SC, the Program also coordinates with other relevant DOE efforts, including those in the Advanced Research Projects Agency-Energy (ARPA-E); the Office of Cybersecurity, Energy Security, and Emergency Response; and crosscutting DOE initiatives such as the Energy Storage Grand Challenge, Advanced Manufacturing, Grid Modernization, Integrated Energy Systems, Water Security Grand

Challenge, and Artificial Intelligence. Each of these offices and initiatives manage hydrogen technology activities related to their missions. EERE, FE, and NE focus their RD&D activities on their respective energy sources, feedstocks, and target applications. All of these activities are coordinated to achieve a cohesive and strategically managed effort.

Hydrogen at Scale—A Guiding Framework

H2@Scale22 is a DOE initiative that provides an overarching vision for how hydrogen can enable energy pathways across applications and sectors in an increasingly interconnected energy system. The H2@Scale concept, is based on hydrogen’s potential to meet existing and emerging market demands across multiple sectors. It envisions how innovations to produce, store, transport, and utilize hydrogen can help realize that potential and achieve scale to drive revenue opportunities and reduce costs

Today, the primary demand for hydrogen is as a chemical feedstock in petroleum refining and ammonia production, with smaller amounts being used in other industrial applications such as methanol production.

Approximately 10 million metric tons (MMT) of hydrogen are currently produced in the United States each year for these end uses, mostly from natural gas. In the H2@Scale vision, hydrogen’s versatility as a both a chemical feedstock and an energy carrier will be harnessed to serve expanded end-uses. Emerging market-opportunities include the use of hydrogen for multiple transportation applications (e.g., in fuel cell electric vehicles—particularly heavy duty applications—as a feedstock for synthetic fuels and to upgrade petroleum and bio-fuels); as a feedstock for industry (e.g., in steel and cement manufacturing); for heat in industrial systems and buildings; for power generation (for large-scale power, off-grid distributed power and back-up or emergency power); and for energy storage. Hybrid energy systems, which integrate energy generation, storage, and/or conversion technologies to optimize the overall value of the energy generated, are another promising market opportunity, as discussed in the Applications section of Chapter 3 of this Plan. For example, the integration of hydrogen production technologies with utility-scale power generation plants is a concept receiving increased interest, due to its potential to improve profitability of these plants while supporting grid resiliency.

The ultimate goal of H2@Scale is for hydrogen to be affordably produced and delivered utilizing several feedstocks, processing methods, and delivery options at a variety of scales ranging from large central production to small local production, depending on what is most practical from an economic and logistical perspective for a given location and level of market demand. To better understand and develop the potential for hydrogen production, demand, and utilization in the United States, the Program conducts coordinated, comprehensive modeling and analysis efforts, which examine the options available, current and potential costs, energy efficiencies, and environmental effects of these options, and tradeoffs between them. Results from these analyses are used to help guide R&D priorities and set program goals, including potential regional focus areas for hydrogen production and utilization, as well as the most viable end-use applications.

Recent H2@Scale modeling and analysis efforts conducted by DOE’s national labs have characterized U.S. hydrogen production and demand potential over the next 30 years.

National labs have assessed various scenarios that show a range from 22 to 41 MMT/year as the economic potential for hydrogen demand— two to four times the current demand.

As new markets emerge (such as off-road transportation like marine applications or data centers), this economic potential may increase and will be assessed periodically through updated analyses.

In addition to DOE analysis, a group of over 20 industry partners projected a two-fold increase in hydrogen demand, to 20 MMT, by 2050 as a base case scenario, and a six-fold increase in an ambitious scenario.

Given uncertainties across sectors, markets, and technologies, these results are fairly consistent. Based on these two scenarios (“base” and “ambitious”), hydrogen could account for between 1% and 14% of total energy demand in the United States.

The Program has also determined the availability of domestic resources for hydrogen production across the country. The nation’s energy resources are geographically widespread, and fossil, nuclear, and renewable feedstocks are each independently sufficient to support at least a doubling of domestic hydrogen consumption.

Program Strategy

DOE is funding RD&D efforts that will provide the basis for the near-, mid-, and long-term production, delivery, storage, and use of hydrogen derived from diverse domestic energy sources. In order to capture the full range of benefits that hydrogen offers, the Program aims to advance hydrogen and related technologies for a wide variety of applications, with varying timeframes for commercial adoption.

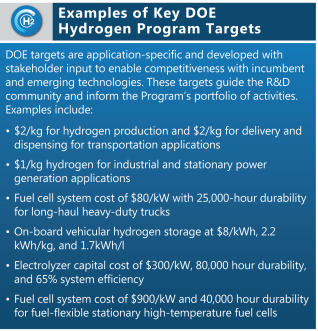

The Program has defined targets for hydrogen and related technologies based on the technical advances that are needed to be competitive in the marketplace with incumbent and other emerging technologies.

Examples of the Program’s overarching technical targets are shown in the Figure. More-detailed, technology- and application-specific targets and milestones are included in each office’s multi-year planning documents. These targets have been identified through discussions with technology developers, the research community, and other relevant stakeholders.

The Program is addressing key challenges to achieving the H2@Scale vision by conducting activities to:

- Reduce costs and improve the performance and durability of hydrogen production, delivery, storage, and conversion systems

- Address technological, regulatory, and market barriers that both limit the integration of hydrogen with conventional energy systems and reduce opportunities for exporting hydrogen

- Explore opportunities for achieving large-scale adoption and use by aggregating disparate sources of hydrogen supply and demand

- Develop and validate integrated energy systems utilizing hydrogen

- Demonstrate the value proposition for new and innovative uses of hydrogen

To see more link : https://www.hydrogen.energy.gov/pdfs/hydrogen-program-plan-2020.pdf

Appendix A: Domestic energy resources required to produce 10 MMT of hydrogen

A key aspect of the Department’s hydrogen strategy is to enable hydrogen production from a diverse array of lowcarbon domestic energy resources, including renewable resources (such as biomass, wind, and solar energy), nuclear energy, and fossil fuels (with CCUS). Rather than select a specific market penetration assumption to determine the demand for hydrogen, the quantity of 10 MMT was selected as an example, as it represents current annual domestic hydrogen production. The figure shows the amount of each energy resource (e.g., natural gas, coal, wind, solar, etc.) that would be required if all 10 MMT of today’s hydrogen production volume were to be produced by that single resource alone. That amount is then compared with both the current use of that resource and its projected use in 2040.

In the future, growth in hydrogen production is likely to be met through a combination of these resources, rather than any single resource alone. It is also important to note that what is shown here does not represent all the potential production pathways—there are a number of other promising pathways under development, including direct conversion of solar energy through photoelectrochemical means, waste to hydrogen, biological approaches, and high-temperature thermochemical systems.

To see more link : https://www.hydrogen.energy.gov/pdfs/hydrogen-program-plan-2020.pdf

CANADA STRATEGIES

On December 16, 2020, the Government of Canada released its Hydrogen Strategy for Canada (the “Canada Strategy”). In addition to positioning Canada as a global, industrial leader in the area of clean renewable fuels, the Canada Strategy aims to help Canada achieve net-zero emissions by 2050. The Canada Strategy relies and builds on existing policy measures, including Canada’s recently announced Climate Plan, carbon pricing, the Clean Fuel Regulations, the $1.5 Billion Low-carbon and Zero-emissions Fuels Fund, and the Incentives for Zero-Emission Vehicles program.

At the heart of the Canada Strategy are:

- a 30-year roadmap containing near- to long-term goals; and

- various recommendations which have been proposed in eight “pillars.”

Near term: laying the foundation. For the first five years (2020-2025), the focus will be on planning for and developing new hydrogen supply and distribution infrastructure to support early deployment HUBs in mature hydrogen applications while supporting Canadian demonstrations in emerging applications.

Mid term: growth and diversification. Between 2025-2030, the focus will be on the growth and diversification of the hydrogen sector. Early deployment HUBs will grow and new ones, connected by corridor infrastructure, will be initiated. As the technology matures and the full suite of end-use applications is at or near commercial readiness, hydrogen use in the mid-term will be focused on the applications which provide the best value proposition relative to other zero-emission technologies.

Long term: rapid market expansion. In the 2030-2050 timeframe, the Strategy aims for market expansion. During this period, new transportation applications will move into the commercial and rapid expansion phases, and dedicated hydrogen pipelines will become an attractive alternative as the percentage of hydrogen in natural gas systems increases.

Key Pillars. The Strategy contains 32 recommendations across the following eight pillars:

- Pillar 1: Strategic Partnerships – use existing and new partnerships to collaborate and plan the future of hydrogen in Canada.

- Pillar 2: De-Risking of Investments – establish funding programs, long-term policies, and business models to encourage industry and governments to invest in growing the hydrogen economy.

- Pillar 3: Innovation – take action to support further R&D, develop research priorities, and foster collaboration between stakeholders to ensure Canada maintains its competitive edge and global leadership in hydrogen and fuel cell technologies.

- Pillar 4: Codes and Standards – modernize existing codes and standards and develop new ones to keep pace and remove barriers to deployment, domestically and internationally.

- Pillar 5: Enabling Policies and Regulation – ensure hydrogen is integrated into clean energy roadmaps and strategies at all levels of government and incentivize its application.

- Pillar 6: Awareness – raise awareness of hydrogen’s safety, uses, and benefits as technology develops.

- Pillar 7: Regional Blueprints – implement a multi-level, collaborative government effort to facilitate the development of regional hydrogen blueprints.

- Pillar 8: International Markets – work with international partners to ensure the global push for clean fuels includes hydrogen so that Canadian industries thrive at home and abroad.

Towards a thriving hydrogen economy. According to the Strategy, by 2050 hydrogen economy has the potential to generate $50 Billion in domestic revenue; create more than 350,000 jobs; and deliver up to 30% of Canada’s end-use energy, abating up to 190 Mt-CO2e of GHG emissions through deployment in transportation, heating, and industrial applications. Looking beyond Canada, the Strategy notes that the global market for hydrogen is being valued at $2.5-$11.7 Trillion by 2050.

Policy Opportunities

Canada’s ability to achieve these policy goals will be significantly affected by how governments approach hydrogen strategies and where government dollars are spent. To that end, Canada should:

- Ensure that any subsidies for hydrogen are in line with the government’s commitments to phase out inefficient fossil fuel subsidies by 2025, achieve net-zero emissions by 2050 and accomplish its Nationally Determined Contribution under the Paris Agreement. Subsidies and public finance for fossil fuels put these goals in jeopardy.

- Thoroughly evaluate the potential efficiency of subsidies for hydrogen against robust social, environmental, and economic criteria. Based on IISD’s analysis:

- Subsidies for hydrogen based on natural gas without significant levels of CCS should not be eligible for government assistance.

- Subsidies for blue hydrogen should only occur if blue hydrogen can meet the same level of environmental performance (including emission intensity) and is at or below the cost of green hydrogen. Subsidies for blue hydrogen should not occur if government is not certain that the CCS technology to be used is proven and effective.

- Improve transparency by publicly reporting on direct spending and tax expenditures for hydrogen production. Public money put toward fossil fuel-based hydrogen, including blue hydrogen, should be included in fossil fuel subsidy reporting.

- Follow international best practices being set by Canada’s peers. For example, Germany and Spain have laid out hydrogen strategies prioritizing green hydrogen.