Menu

Hydrogen Gas Market size is forecast to reach 107.2 million tons by 2025, after growing at a CAGR of 4.1% during 2020-2025. The factors that supports the growth of the hydrogen gas market includes the increasing preference for technological advancements, onsite hydrogen generation systems, increasing use of hydrogen across various end user industries and introduction of green production technologies.

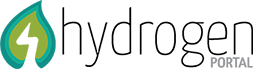

The report: “Hydrogen Gas Market – Forecast (2020-2025)”, by IndustryARC, covers an in-depth analysis of the following segments of the Hydrogen Gas Industry.

Hydrogen Gas Market Analysis

Asia-Pacific dominates the hydrogen gas market owing to increasing demand from various end use industry ranging from chemical to energy & power.

This increasing demand for energy will translate to a definite demand for oil which will lead to an augmented production of oil in the refineries worldwide. Hydrogen is used in refineries for oil refining as it enables the process of converting crude oil into refined fuels such as gasoline and diesel while it also removes contaminants such as sulfur from these fuels.

- The growth in the Hydrogen market can be attributed due to increasing demand for clean fuel which is projected to witness exponential growth every year due to rising pollutions.

- The rigorous government regulations to control the sulphur contaminants in fuel is expected to drive the market growth.

- Type of Fuel – Segment Analysis

- Captive use segment held the largest share in the hydrogen gas market in 2019. Increasing demand of on-site hydrogen generation and consumption in various industries including oil refinery, ammonia and methanol production.

- End-Use Industry – Segment Analysis

- Ammonia production segment held the largest share in the hydrogen gas market in 2019 and is expected to grow with the CAGR of 3.9% over the forecast timeframe. According to the International Trade Center (ITC), the global trade of ammonia was valued to be $6,382.7 million in 2018, and the future foresees increased demand for ammonia in the HVAC sector as it is used as a refrigerant. The demand for hydrogen in ammonia production is projected to increase with a CAGR of 2.5% through to 2025.

- Geography – Segment Analysis

- Asia Pacific is the largest market with the market share of 42% in 2019 for hydrogen gas market globally. Robust economic performance along with increasing growth rates are projected to hold China’s position as an economic superpower, with large scale investments in Research and Development (R&D) are predicted to enhance market growth. The oil & gas and pharmaceutical industries are booming in the region with a lot of investments being made by the governments and overseas investors. China’s aerospace industry is advancing in a rapid manner which is increasing the demand for hydrogen in the country. The perpetually growing agricultural industry in APAC has led to enhanced production of fertilizers, which is significantly supporting the hydrogen market. APAC had the maximum hydrogen gas market share of 42% in 2019.

-

- The European market for hydrogen generation includes major countries such as Spain, U.K., Italy, Germany, and Russia along with other European countries. In 2018, Europe was the second largest in terms of revenue share. Growing demand for superior quality and reliable supply for various industries, majorly in the commercial sectors are anticipated to be the primary regional drivers.

- Drivers – Hydrogen Gas Market

- Augmenting demand and production of fertilizer globally

- According to the Food and Agricultural Organization of the United Nations (FAO), the global demand for phosphate fertilizer will be 118,763 thousand tons in 2020 as the organization projects that it will grow with a CAGR of 1.54% during the forecast period of 2015 to 2020. Fertilizers utilize ammonia in production, and hydrogen is a key component of the same. The future foresees growth of the agriculture industry which will play a vital role in fulfilling the sustainable development goals (SDGs) of the United Nations (UN). This growth will create a demand influx the fertilizers market which will generate lucrative opportunities in the hydrogen gas market.

- Augmenting demand and production of fertilizer globally

-

- Growing demand of fuel cell electric vehicles

-

- Under the Energy Policy Act of 1992, hydrogen is considered an alternative fuel. The interest in hydrogen as an alternative transport fuel stems from its ability to drive zero-emission FCEV fuel cells, its domestic production capacity, its quick filling time, and the high efficiency of the fuel cell.

- Growing application of hydrogen gas as fuel cell in automotive sector is also enhancing overall growth of the market. The global fuel cell electric vehicle (FCEV) car stock have reached about 8,000 units in April 2018. The U.S represents the largest stock with 4,500 FCEV, mainly registered in California where zero emission vehicle program has driven the sales of the stock. On the other side, Japan has the second-largest FCEV stock with 2,400 units, followed by Germany and France. In APAC region, the consumption of hydrogen fuel cell can be majorly seen in trucks as well as passenger buses in China, about 2,000 mid-size trucks and 280 buses produced as of June 2018. Whereas, in Europe, the Fuel Cell and Hydrogen Joint Undertaking (FCH JU) is conducting a new bus project which will contain 100% fuel cell usage, they are aiming to deploy around 300 buses in 20 cities by 2022.

-

- Growing demand of fuel cell electric vehicles

-

-

- Growth in semiconductor market

- The semiconductor market was valued to be $426.4 billion as of 2018, and the demand for semiconductors is projected to observe a substantial CAGR of 5.88% over the forecast period of 2019 to 2025. Hydrogen is omnipresent during the growth and processing of semiconductors as it is used as a carrier gas. Perceptibly, the estimated growth in demand for semiconductors is poised to enhance growth prospects in the hydrogen gas market.

-

- Challenges – Hydrogen Gas Market

- High cost of fuel cell

- Market Landscape

- Technology launches, acquisitions and R&D activities are key strategies adopted by players in the fuel additives market. In 2019, the market of hydrogen gas has been fragmented with many players. Major players in the Hydrogen Gas Market are INOX Air Products Ltd., Airgas, Inc., Air Liquide S.A., Hydrogenics Corporation, Iwatani Corporation, Linde AG, Messer Group GmbH, and Praxair, Inc., BASF, among others.

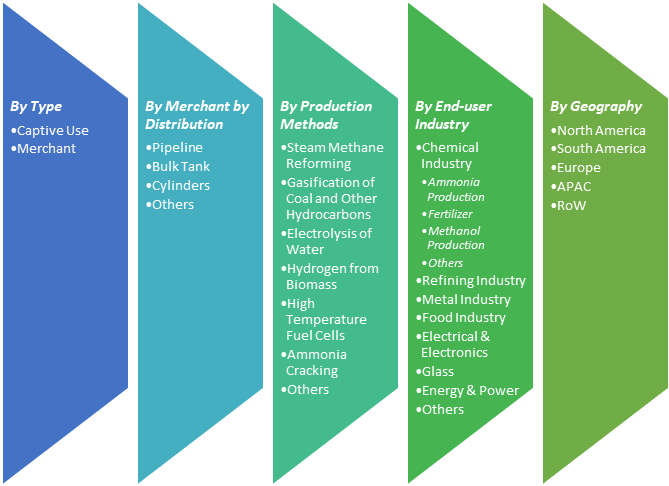

Potential Hydrogen Energy Market

In order to develop a fully functional hydrogen energy system, first, potential hydrogen energy markets for all related technologies should be identified. This task is not always very easy, specifically because of the fact that most of the technologies used in hydrogen energy systems are still in their early stages of market introduction. Nevertheless, hydrogen’s resourcefulness and viability in many applications, such as in fuel cells, show that hydrogen is safe and appropriate in a broad range of end-use applications. In addition, the versatility of hydrogen offers a foundation for the valuation of the hydrogen energy market requirements.

Hydrogen energy markets serve a broad range of end-use applications from fuel cell markets for portable consumer electronics to micro-CHP systems for heat and power production and transportation. The American Institute of Chemical Engineers (AIChE) [63] has presented that the main areas for future hydrogen energy markets are expected to mainly depend on the following four elements:

- Current and future costs of hydrogen energy systems.

- Advancement rate of various hydrogen energy system technologies.

- Current and future costs of alternative energy systems.

- Current and future rules and regulations on GHG emissions.

Along with the economic, environmental, and energetic performance of the alternative technologies, there are sociological (e.g., behavioural) uncertainties about the widespread utilization of hydrogen-fuelled vehicles. An example of these uncertainties is the consumer acceptance of new technologies. For instance, when it comes to BEVs, there are a couple of important behavioural questions to ask, such as whether or not the vehicle owners would accept low-driving vehicles, how often vehicle owners would be willing to charge their vehicles, etc. Driving range is especially a critical issue when developing alternative transportation vehicles. With the current available technologies, ICE-powered vehicles offer durable, reliable, affordable, safe, and long-range driving to drivers that hydrogen-fuelled vehicles or BEVs cannot compete with.

Another example of vehicle charging concerns is related to BEVs; in the long-term, it is expected that severe problems will surface related to BEV charging and its impacts on the local, national, and global electricity grid. The reason for these concerns is the fact that most owners are expected to charge their vehicles during peak consumption periods, which generally means after business hours, which end around 6 p.m. or so. In addition, currently, there are not many studies on potential BEV owners’ charging preferences and behaviours. The University of Birmingham Fuel Cell Group has conducted different simulations and modelling studies on BEV drivers in England and so far, they have concluded that the majority of owners and drivers prefer charging their vehicles during peak times in contrast with the recommended use during off-peak times .

An additional and much more important element that affects the hydrogen energy market in the transportation sector is the GHG emissions reduction that could be achieved with hydrogen compared to other alternative fuel options with low emissions, such as biobased fuels. In the transportation sector, biobased fuels can potentially become the most cost-effective, clean, reliable, and efficient alternative to traditional fossil fuel-based transportation fuels, which poses a threat to hydrogen energy market expansion. The reason for the potential success of biobased fuels is their ease of production, delivery, and end use. In addition, biobased fuels may not necessitate a drastic infrastructure renovation.

As mentioned earlier, biobased fuels have several advantages as transportation fuels. However, in spite of their substantial potentials, biobased fuel sources cause a lot of polemics. An important concern about biobased fuels is related to the conservation of agricultural lands. Unless biobased fuels are derived from industrial, agricultural, or municipal waste, there will always be a “food versus fuel” debate on biobased sources. In addition, in order to be considered as truly renewable, the biobased fuels should be replenished at a higher (or equal) rate compared to their rate of consumption. Furthermore, a thorough well-to-wheel analysis should be conducted to evaluate the net GHG emissions related to biobased fuel use.

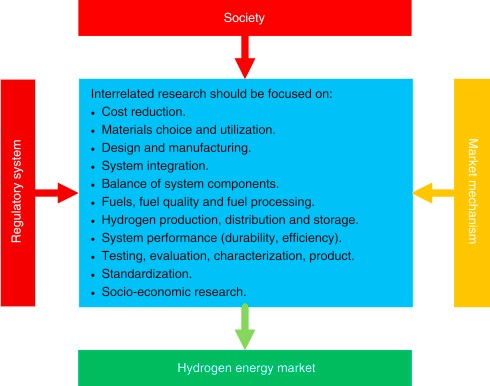

Over and above the issues highlighted here so far, there are some political aspects and policy-related issues that significantly affect the expansion of the hydrogen energy market, especially hydrogen in the transportation sector. There needs to be specific consumer-driven demand for the successful growth of the hydrogen energy market and extensive use of hydrogen as a transportation fuel. Until now, there has been no significant demand from key consumer groups on the use of hydrogen as a transportation fuel [65]. Transition to hydrogen use in the current transportation industry requires substantial policy changes. This is a unique situation because there have been no major energy system shifts in history with such policy change requirements.

In the late 19th century, the main reason for the evolution from horse-driven transportation to ICE-driven vehicles was the demand coming from vehicle users to be able to travel longer distances [66]. Since there has been no major consumer demand for hydrogen-powered vehicles, the responsibility for a successful transition to a hydrogen economy is on local and state-level governments, representatives from various industries and institutions, and hydrogen energy system supporters to accelerate the transition to a fully developed hydrogen energy market by leading:

- Behavioural transition: for hydrogen to be accepted by all end users.

- Technological demonstrations: to prove that the hydrogen energy market is ready.

- Competitive assessments: demonstrate the advantages of hydrogen compared to other existing alternatives.

- Net and overall energy densities: increasing the amount of hydrogen in the mixture reduces its energy density.

- Wobbe number: increasing the amount of hydrogen in the mixture (up to around 70 vol%) reduces its Wobbe number slightly (it should be noted that this might not be regulated in some countries).

- Ignition characteristics: increasing the amount of hydrogen in the mixture reduces its “knock tendency.”

- Burning velocity: increasing the amount of hydrogen in the mixture (up to around 30 vol%) increases its burning velocity.

Key requirements for successful hydrogen energy market deployment. Modified from Chu S, Majumdar A. Opportunities and challenges for a sustainable energy future.

Several companies and bodies are testing with positive results the emission of 10% of hydrogen in the methane gas lines and the use of 30% of hydrogen in alloy production process.

BOX : THyGA: Testing Hydrogen admixture for Gas Applications

The project THyGA (Testing Hydrogen Admixtures for Gas Appliances) has launched the 28th of January 2020, with a first meeting at the GERG office in Brussels. Funded by the FCH JU work programme, THyGA sets out to develop and communicate a detailed understanding of the impact of blends of natural gas and hydrogen on end use applications, specifically in the domestic and commercial sector.

The project is being coordinated by Engie. Eight other partners from six European countries (DGC, Electrolux, BDR, Gas.be, CEA, GWI, DVGW-EBI and GERG) will work together on this project over 36 months. The consortium includes laboratories, gas value chain companies, manufacturers representing different applications (cooking, heating), and an international association. It will be supplemented by an advisory panel of manufacturers and gas companies which will be closely integrated with the main project team.